- The telecommunications equipment supply market is evolving with the expected emergence of Open RAN.

- This section focuses on the major procurement announcements by mobile operators of which vendors have been selected for 5G roll outs.

Supply market trends (vendors): Major procurements, Open RAN, multivendor deployments

The telecommunications equipment supply market is evolving with the expected emergence of Open RAN offers alongside those of traditional vendors. Some governments and regulators are showing interest in these future offers, with the objective of further supporting a diversification of the telecommunications vendor supply chain. This trend originates from the technological capability to provide network functions through implementation of software functions running in the cloud and to provide open interfaces in addition to those already defined by 3GPP. It may provide for a more diverse supply ecosystem and is assumed to provide operators with more flexibility to implement innovation in their networks.

This section focuses on the major procurement announcements by mobile operators of which vendors have been selected for 5G roll outs, an overview of the recent Open RAN deployments and any impact this may have across the EU, in particular on growth of the wider vendor mix.

Major procurements

There have been a number of major procurements by large operators across EU countries in recent months. The following table shows which vendors have won contracts for the provision of 5G network builds across Member State countries.

Major procurements

Open RAN overview

Open Radio Access Network (OpenRAN) is a network architecture with three driving components:

- Opening of interfaces to enable interoperability between equipment from different vendors enabling multi-vendor implementations and interoperability between different vendor equipment (X2, Xn, Open fronthaul interface)

- Virtualisation of RAN functions and implementation in (edge) clouds. This part is commonly known as vRAN

- Automation, through new interfaces enabling data collection and RAN management through the RAN Intelligent Controller (RIC), eventually using AI/ML techniques

There are two main initiatives working together to progress the Open RAN concept: Telecom Infra Project (TIP) via their OpenRAN project group and the O-RAN Alliance. The TIP OpenRAN project group is “an initiative to define and build 2G, 3G and 4G RAN solutions based on general purpose, vendor-neutral hardware and software-defined technology”. There is also the OpenRAN 5G NR project group which focuses on 5G NR technology.

The O-RAN Alliance are developing industry specifications targeting i) production of interoperable equipment, or at least equipment that is capable of being interoperable; ii) reference implementation of RAN functions in clouds; and iii) RIC specifications.

More details of each group are provided below.

TIP – OpenRAN project group

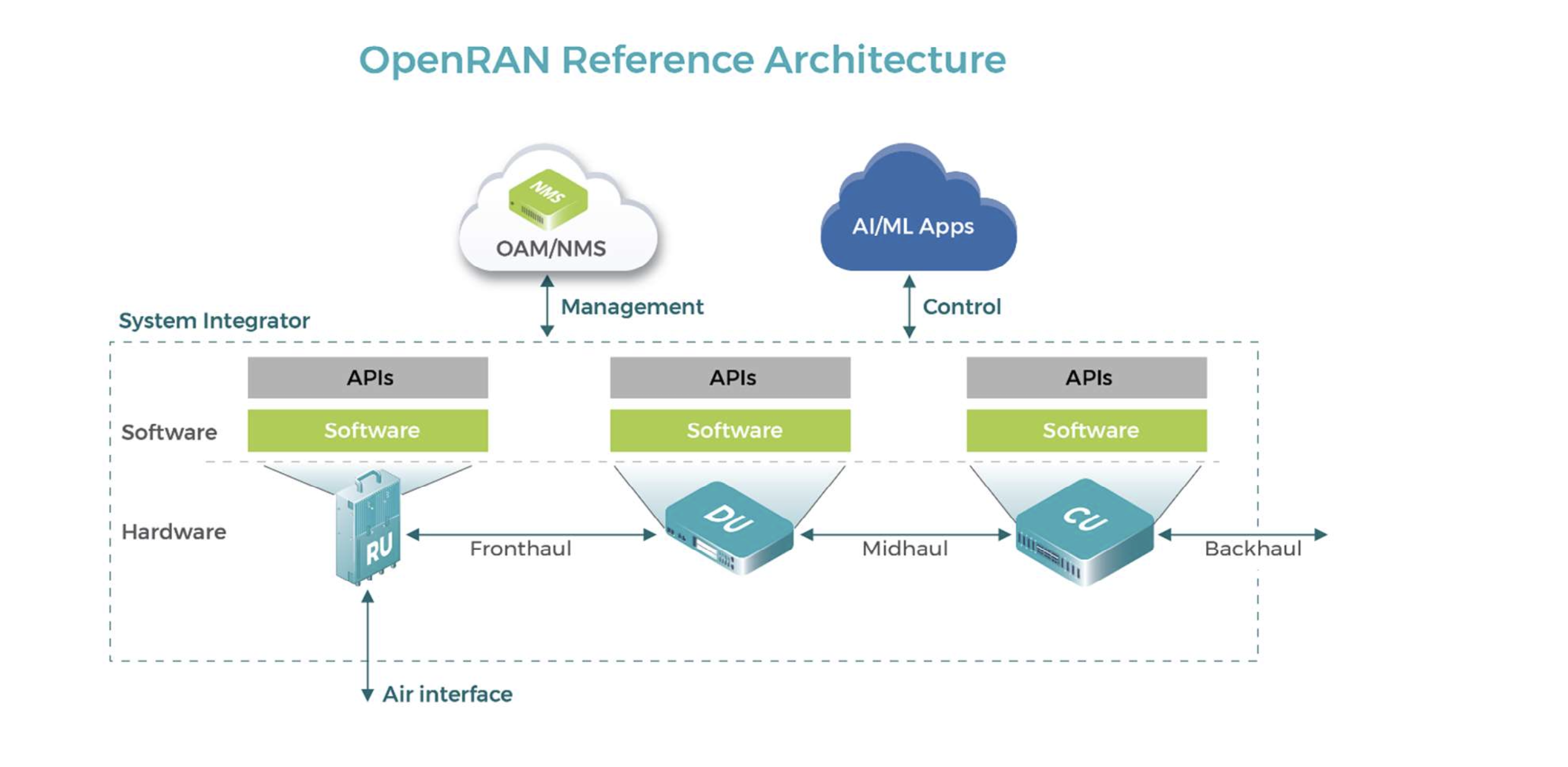

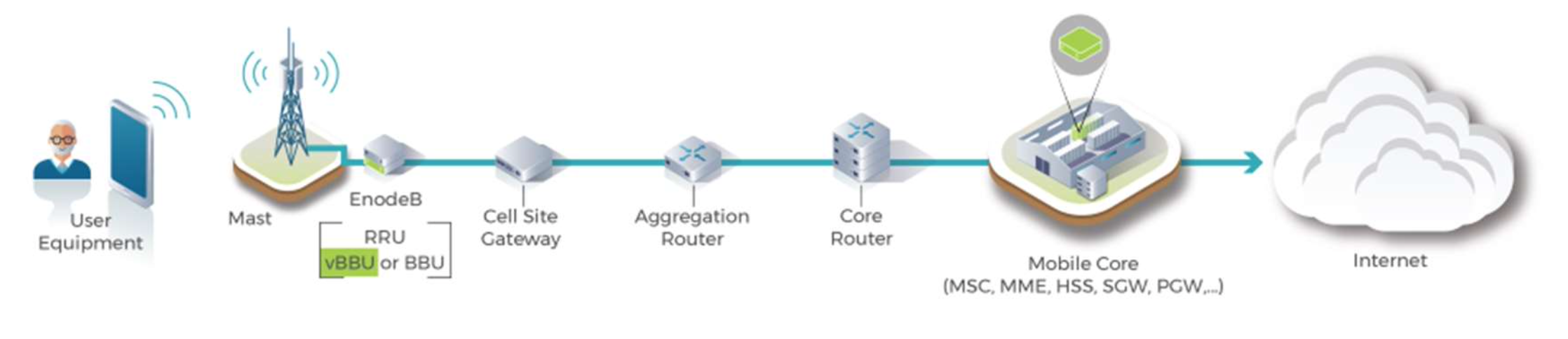

The focus of the TIP OpenRAN project group is on deployment and execution ensuring the hardware from across the vendor ecosystem can interoperate. It supports trials, field testing and live deployments. It has developed the OpenRAN reference architecture (shown below) which demonstrates how the key components for both hardware and software fit together. It also shows between which components the different interfaces (backhaul, middlehaul and fronthaul) are placed within the network architecture.

OpenRAN reference architecture. Source: Telecominfraproject.com

OpenRAN reference architecture. Source: Telecominfraproject.com OpenRAN end to end architecture: Telecominfraproject.com

OpenRAN end to end architecture: Telecominfraproject.comThe key Open RAN principles include:

- Disaggregation of RAN Hardware & Software on vendor neutral, 3GPP-based platforms

- Open Interfaces – Implementations using open interface specifications between components (e.g. Radio Unit – RU/Centralised Unit – CU/Distributed Unit – DU/RAN Intelligent Controller – RIC) with vendor neutral hardware and software.

- Multiple Architecture Options, including

- An all-integrated RAN with disaggregation at SW and HW level

- A split RAN with RU, BBU (DU/CU)

- A split RAN with RU, DU and CU

- A split RAN with integrated RU/DU, CU

- Flexibility – Multi vendor solutions enabling a diverse ecosystem for the operators to choose best-of-breed options for their 2G/3G/4G and 5G deployments

- Solutions implemented on either Bare Metal or Virtualized or Containerized Platforms

- Innovation via Adoption of New Technologies (AI/ML, CI/CD…)

- Diversification of the supply chain.

Open-RAN Alliance (O-RAN)

The Open RAN Alliance was founded by operators (DT, Orange, CMCC, AT&T, NTT DoCoMo) with the aim to promote and create a more software-focused and virtualised network environment. It is supported by several hardware vendors, including Intel, AMD, RISC, ARM, NVIDIA, HP, Lenovo, Dell, Nokia, Ericsson. O-RAN has more than 200 members, made up primarily from the members of the now merged C-RAN (CMCC) and X-RAN initiatives (AT&T).

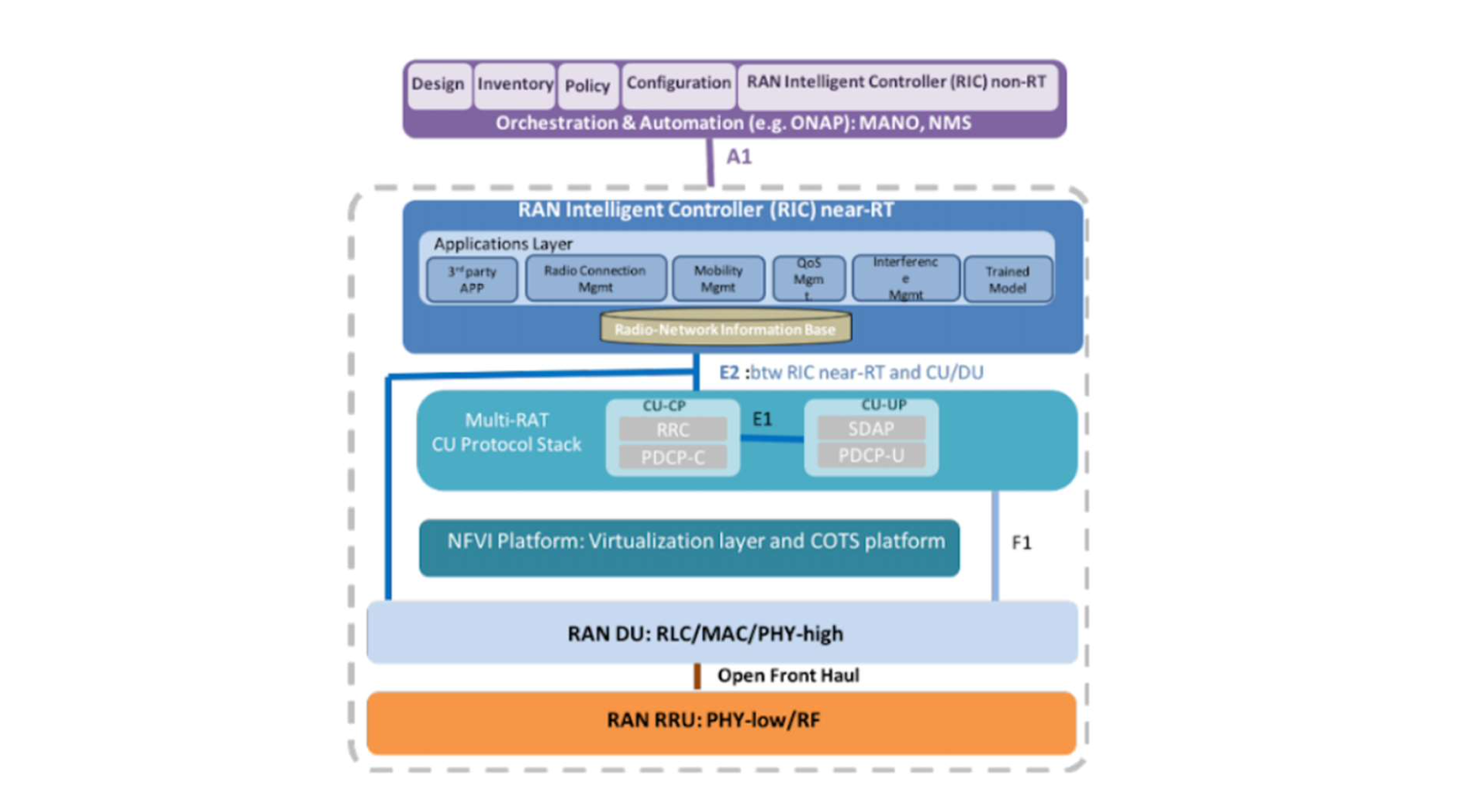

The focus of the O-RAN Alliance is to transform the RAN industry towards “Open, Intelligent, Virtualised and Fully Interoperable RAN”. The O-RAN Alliance has produced a reference architecture and specifications that vendors can use for trials and live deployments. One key difference of the O-RAN Alliance compared to TIP’s OpenRAN project group is the Alliance’s aim to build virtualisation on open hardware via the cloud with embedded AI-powered radio control. This is shown in the reference architecture below.

O-RAN Alliance reference architecture. Source: O-RAN Alliance

O-RAN Alliance reference architecture. Source: O-RAN AllianceIn addition, the O-RAN Alliance is more focused on 4G and 5G whereas TIP’s OpenRAN project group is focused on all mobile generations from 2G through to 5G.

Joint European Ecosystem

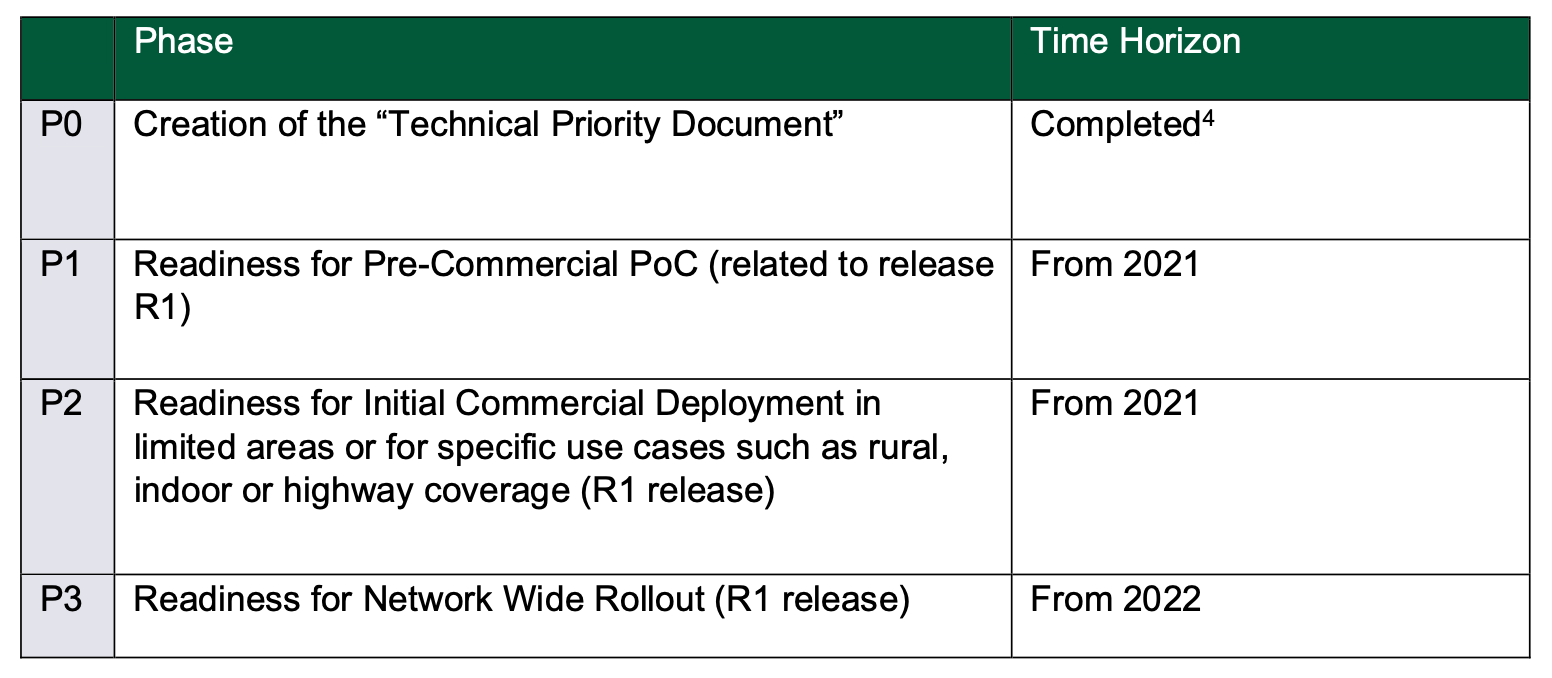

Signed by Deutsche Telekom, Orange, Telefónica and Vodafone agreed an MoU that has the following timescales for a standardised rollout of Open RAN network elements.

The signatories expect readiness and maturity of Open RAN for deployment in accordance with following definition of implementation phases. More detailed definition of phases, milestones and dates can be derived from the agreed activities listed in Article 4 of the MoU.

Open RAN MoU implementation phases and releases

Open RAN MoU implementation phases and releasesIn November 2021, a report was published by Analysys Mason on behalf of the 5 operators having signed the Open RAN MoU highlighting possible priorities for Europe to accelerate the development and deployment of Open RAN. The report ‘Building an Open RAN ecosystem for Europe’ compares the number of Open RAN players in Europe against the rest of the world. The report identifies five key policy recommendations to help Europe “maintain a lead in the development and deployment of next generation mobile networks”. The recommendations include:

- Ensure high-level political support for Open RAN

- Create a European roadmap for network innovation

- Incentivise and support EU Open RAN development

- Promote European leadership in O-RAN standardisation

- Engage in international partnerships

Known uses of Open RAN

This section lists example deployments of Open RAN equipment globally, where it has been publicly announced. Upcoming deployment notices where there is a high probability of it being deployed are included.

Known uses of OpenRAN

In addition, Deloitte has found 35 active Open RAN pilots across the globe. This is being driven by optimised Total Cost of Ownership, higher vendor flexibility and easier upgradeability. It is further noted that in some countries (including EU Member States) that certain vendors are no longer permitted for use in networks and this may accelerate adoption further.

OpenRAN deployments globally. Source: Deloitte

OpenRAN deployments globally. Source: DeloitteAt this stage, most of the Open RAN deployments are pilots intended to validate the technology. The most advanced deployments are mostly targeting low-density rural zones where it is possible to assess the capabilities of the technology in a low traffic environment.

Out of more than 200 commercial 5G networks in the world, two are fully applying Open RAN principles (though with specific specifications): Dish and Rakuten.

Next steps for Open RAN

It is anticipated that Open RAN deployments will start to increase globally as the technology and capability matures. One research company, Dell’Oro predicts that total operator investment in OpenRAN including hardware, software and firmware (but excluding services) will reach $10 billion – $15 billion over the 2020 – 2025 period. However, this highly depends on the speed to market of the technology as market opportunities are shrinking as networks are being deployed with classical solutions from established vendors.

In Europe, a number of mobile operators have expressed interest and commitment, as exemplified by the pilot trials, to further investment and roll out of OpenRAN solutions which include 5G.

The Open RAN approach has also opened a debate between market players and policy makers concerning a number of areas where the technology has not yet proven its maturity at the moment. Some of these areas are the overall performance of Open RAN systems, the integration challenges with existing infrastructures, energy efficiency, cybersecurity resilience in a context of a larger attack surface and the possibility of the emergence of “gate keepers” at some levels in the supply chain (chips, cloud, etc). In that context, Vodafone has identified the need for high performance processors to reach the full Open RAN potential and has initiated an initiative in the field of micro-electronics components.