National 5G Strategies

Main points

- Between July 2017 and September 2017, RTR launched a public consultation on 5G spectrum auctions.

- 4-3.8 GHz SCA (Simple Clock Auction) took place in March 2019.

- 700 MHz/1500 MHz/2100 MHz, expected in August 2020

- 5G Strategy for Austria, April

- All MNOs started 5G

- T-Mobile Austria 5G launch in March 2019

RTR consulted three times on 5G spectrum between July 2017 and February 2018, finally opting for a SCA on 3.4-3.6 GHz bands scheduled in February 2019. On May 28th, 2018, TKK decided on the revision of the Position Paper on Infrastructure Sharing in Mobile Networks.

The Austrian Government set up a steering group for 5G in February 2017. The “5G strategy for Austria” document was approved in April 2018.

The document defines three phases:

- Pre-commercial 5G tests are expected to be held during the first phase by mid-2018

- By year-end 2020, nationwide availability of 100 Mbps connections should be almost This creates the basis for a nationwide expansion of 5G. At the same time, the market launch of 5G in all provincial capitals should take place.

- In Phase 3, 5G should be accessible across the main traffic roads by year-end 2023, followed by nationwide coverage two years

It lists 24 actions in terms of spectrum, funding, research…, translating into ten concrete measures for 5G applications.

On Dec 20, 2018, the consultation on the product and auction design for the award 700/1500/2100 MHz started. The tender is expected in autumn 2019 and the auction in Q1 2020.

In June 2019, RTR issued a consultation on potential assignments of the 2.3 GHz and 26 GHz bands. The 2.3 GHz band was mentioned in the 2016 Spectrum Release Plan whereas the 26 GHz was not.

In August 2019, the Austrian Government announced the new national broadband strategy ‘Breitbandstrategie 2030’. The strategy aims to provide nationwide access to gigabit-capable broadband services by the end of 2030.

The goals are:

- Nationwide access to 100 Mbps speeds by end 2020

- Launch 5G in all federal state capitals by end 2020

- Becoming a ‘5G pilot country’ by early 2021

- 5G coverage along all main traffic routes by end-2023

- Nationwide coverage of 5G by the end of

In September 2019, the RTR chief said 700/1500 (eight blocks of 10 MHz) /2100 MHz (12 blocks of 2×5 MHz) frequencies to be auctioned in March 2020 will be granted under coverage conditions. A public consultation on conditions and targets was open till October 21, 2019. The government aims for main traffic routes to have 5G services available by the end of 2023, and to have “virtually nationwide” 5G coverage by the end of 2025. 700 MHz licences will include coverage of 900 underserved communities with speeds of 30 Mbps download and 3 Mbps upload, 90% of federal and state roads – to enjoy at least 10 Mbps download and 1 Mbps upload. In December 2019, the RTR published terms and conditions for the 2nd 5G spectrum auction scheduled for April 2020: it decided to lower the minimum bid by 55 million EUR to 239.3 million EUR, it also increased the duration of the licences from 20 to around 25 years. The auction was postponed due to Covid-19 in the second half of August 2020 instead of April 2020.

In April 2020, the draft regulation on security measures for 5G networks was debated. The draft ordinance proposed in Austria establishes (a) a common set of rules applicable to all telecommunications networks; and (b) particular obligations for operators to protect the security of 5G networks (for networks with more than 100,000 users). The rules established for operators include:

- the obligation to notify a security incident that has a significant impact on the security of the communications network;

- the obligation to design and implement a security policy that ensures an adequate level of security in relation to existing risks;

- a set of obligations for 5G network operators with more than 100,000 users, such as:

- to regularly submit an audit report;

- to submit a declaration of conformity attesting to the observance of international standards such as 3GPP, expressly mentioned in the annex of this order;

- to ensure the operation of the network operations center and the security operations center in the European Union;

- to effectively monitor all critical components and sensitive parts of 5G networks through the network operations center and the security operations center;

- to prevent unauthorized change of networks or components;

- to ensure the physical protection of the critical and sensitive components of 5G networks;

- restrict access to competent and qualified personnel, previously subject to security checks;

- use of appropriate tools to ensure software integrity when operating software updates;

- to establish a strategy to ensure the provision of infrastructure by several providers, including by taking into account technical constraints and interoperability requirements in different parts of other 5G

In May 2020, Vienna announced it plans to increase 5G coverage by subsidizing new sites deployment locally between July 2020 and June 2022. The city expects to spend 20 MEUR.

Main points

- Draft strategic plan 2020-2022 late in 2019 opened to public consultation including information about the planned multi-band spectrum auction.

- BIPT granted temporary 5G 6-3.8 GHz licences to five players (Entropia Investments, Telenet, Proximus, Orange Belgium) in April 2020. Licences are valid until a traditional auction procedure takes place. Entropia Investments failed to pay for the permit and lost it in October 2020.

- Launch of 5G services by Proximus on April 1st, 2020

- 700 MHz and 3.5 GHz auction not expected before year-end 2021

Royal Decrees adopted in July 2018 among which draft regarding the 700 MHz, 1500 MHz and 3600 MHz bands. Plans released in September 2018.

In July 2018, Royal Decrees were adopted among which draft regarding the 700 MHz, 1500 MHz and 3600 MHz bands. In September 2018, the BIPT released its plans for the introduction of 5G in Belgium. 700 MHz, 3400-3800 MHz and 1500 MHz (SDL, or Supplementary Downlink) frequencies are expected to be auctioned in the autumn of 2019. The 26 GHz band auction will not take place before 2021. Upper frequencies (31.8-33.4 GHz and 40.5-43.5 GHz) should be auctioned as from 2022.

The BIPT provided consultations on the introduction of 5G in Belgium in September 2018, a communication regarding the introduction of 5G in Belgium (September 2018) and the national strategy for 700 MHz band in October 2018. The BIPT gave details on the 700 MHz auction in November 2018. Bids will start at a reserve price of 20 million EUR per 5 MHz block for 20-year licenses.

In May 2019, the BIPT issued a consultation on its draft decision to deny CityMesh’s request to add some municipalities to its 3.5 GHz band licence. It also opened a public consultation to assess interest in using the 26GHz band for 5G services. It believes it possible to assign six blocks of 200MHz without migrating the band’s existing users, while a further ten blocks would be available once the spectrum is vacated.

BIPT published its draft strategic plan 2020-2022 for public consultation until December 8, 2019. The document mentions plans to award the 700 MHz, 1500 MHz, and 3.5 GHz bands, and to renew rights for the 900 MHz, 1800 MHz, and 2.1 GHz bands, which expire in March 2021. The auction has been delayed due to a disagreement over how the amount raised by the sale should be distributed.

Due to the delay in assigning 5G spectrum, BIPT decided to award temporary licensees. In March 2020, Telenet, Orange and Proximus confirmed they applied before the 28 February 2020 deadline. In April 2020, the BIPT granted temporary 5G licences to Proximus, Cegeka, Entropia, Telenet and Orange Belgium. Licensing was followed by the launch of 5G services by Proximus as from April 1st. Orange Belgium started testing 5G. Entropia Investments failed to pay for the permit and lost it. BIPT started to redistribute spectrum to other temporary licensees while Cegeka did not ask for additional spectrum. As a result, Orange Belgium, Telenet and Proximus which got 40 MHz each in April 2020, received 50 MHz while Cegekia will keep 40 MHz.

The auction is not expected before year-end 2021.

Main points

- 5G border corridor Bulgaria, Greece, Serbia.

- 700 MHz and 3600 MHz 5G auction expected in 2021

- 5G launch by A1 on November 20, 2020

The Communications Regulation Commission (CRC) of Bulgaria closed a public consultation on frequency allocations in October 2017. It proposed to sell eight blocks of 5 MHz in the 1.5 GHz band (1452-1492 MHz), three paired blocks of 5 MHz in the 2 GHz band (1920-1935 MHz/2110-2125 MHz), 14 paired 5 MHz blocks of frequency division duplex (FDD) spectrum in the 2.6 GHz band (2500-2570 MHz/2620-2690 MHz), ten blocks of 5 MHz TDD spectrum in the 2.6 GHz band (2570-2620 MHz), 34 blocks of 5 MHz in the 3.6 GHz band (3430-3600 MHz) and further 22 blocks of 5 MHz TDD in the 3.6 GHz band (3645-3700 MHz and 3745-3800 MHz).

In July 2018, Bulgaria, Greece and Serbia signed an agreement to develop an experimental 5G cross-border corridor (Thessaloniki – Sofia – Belgrade) that will test autonomous vehicles.

In December 2018, Bulgaria’s telecommunications authority (CRC) opened a public consultation procedure on a draft decision to adopt an updated regulatory policy for management of radio spectrum. It includes a proposal to redistribute spectrum in the 3400-3800 MHz band for 5G use and define the conditions for use of at least 1GHz of spectrum in 24.25-27.5 GHz band.

Another public consultation was launched on elements of a new radio spectrum policy including redistribution at 1800 MHz, allocation of 2000 MHz frequencies, use of 3400-3800 MHz spectrum, conditions for releasing 1 GHz of 24.25-27.5 GHz frequencies for 5G, allocation of 700 MHz to mobile services.

In October 2019, CRC indicated it had taken actions for the harmonisation of the 5G pioneer bands by amending the regulatory framework.

In November 2019, CRC announced it planned to assign frequencies for 5G by mid-2020. The assignment was further delayed to 2021.

Main points

- 700 MHz, 3.6 GHz and 26 GHz 5G auction planned for H1 2021

- 5G launch by Hrvatski Telekom on October 30, 2020 thanks to Dynamic Spectrum Sharing

The Strategy for Broadband Development in Croatia for 2016-2020 was adopted in July 2016. It aims at achieving full broadband deployment by a technology neutral approach. The estimated budget for the implementation of the Strategy measures is ca. 770 MEUR.

A round table on “introduction of the 5G network in Croatia” was held in May 2018. On January 25, 2019, HAKOM issued a public call for spectrum allocation in 2.5-2.69 GHz for the period of May 2019 until October 2024. The frequencies could be used for 5G.

70 MHz of the 3400-3600 MHz band is not available in north Croatia, in two counties. After November 4, 2023 the entire 3400-3600 MHz band will be available countrywide. The entire 3600-3800 MHz band will be available countrywide after July 31, 2020 while one continuous block of 100 MHz of this band has already been available from September 1, 2019.

In March 2019, Croatia adopted a new plan with 5G as a priority. At the same time, Tele2, A1 and Hrvatski Telekom were awarded spectrum in band 7 (2500-2690 MHz).

On October 18, 2019 HAKOM issued a public consultation on future assignment of 700 MHz, 1500 MHz, 3.6 GHz and 26 GHz bands. Public consultation was open until January 20, 2020 to enable all interested stakeholders to express their views and interests. As a result of the gathered information, HAKOM published a document stating the intention to conduct a public auction for the 700 MHz, 3.6 GHz and 26 GHz frequency bands. The auction was planned for H2 2020, but these plans are currently under revision due to COVID-19 epidemic.

700 MHz band in Croatia is still used for digital terrestrial television in DVB-T/MPEG-2 system. Termination of DVB-T broadcasting in this band to enable its use for wireless broadband was planned for mid-2020, together with transition to DVB-T2/HEVC system on frequencies below 694 MHz. In March 2020 HAKOM postponed transition to DVB-T2/HEVC system and releasing of the 700 MHz band for at least 6 months due to consequences of force majeure caused by COVID-19 pandemic and earthquake in densely populated area of capital Zagreb, on March 22, 2020. Release of the 700 MHz band is also largely conditioned by cross-border coordination (interference situation in 470-694 MHz) and demanding transition procedure as DTT is a dominant TV platform with 48% household’s share.

In January 2020, the Government of the Republic of Croatia has adopted a resolution on Osijek as the Croatian 5G City and Slavonia as the first Croatian region to operate 5G networks commercially. Commercial work on 5G technology in Osijek is expected by the end of 2020. 5G is a prerequisite for utilization of the potential of digital transformation as a key factor for economic growth. For the successful introduction of technology, it is necessary to encourage active co-operation between the relevant state bodies.

In June 2020, HAKOM postponed the multi-band auction (700 MHz, 3.6 GHz and 26 GHz) until the first half 2021 blaming the Covid-19 outbreak.

Main points

- Updated Cyprus Broadband Plan 2016-2020 [1 ]

- 700/3600 MHz 5G spectrum auction completed on 17 December 2020. Four winners: Cyta, EPIC, Primetel and Cablenet Communications Systems

In 2016, the Cyprus Broadband Plan 2016-2020 was published and updated in December 2018, in order to be aligned with the targets of the European Gigabit Society and the 5G Action Plan.

The document covers the strategic objectives, the broadband actions and the national roadmap for 5G. In the long term the objectives are 100% coverage with 30 Mbps and 50% household penetration with 100 Mbps by 2020. The Official procedure for licencing the 5G priorities bands (700 MHz, 3.6 GHz and 26 GHz) is expected in Q4 2019.

On August 30, 2019, the Cyprus government issued a consultation on its plans to auction the 700 MHz, 3.4-3.8 GHz, and 26 GHz bands. The consultation will be opened to public comment until September 27, 2019. The auction was initially scheduled for November 2019 and rescheduled for March 2020. It is now expected by year-end 2020. Licensees will have to provide 40% 5G geographical coverage within 2 years and 85% within 5 years.

In the first months of 2020, concerns about potential adverse health effects of 5G were growing in the country and no licences had been assigned.

700 MHz

Cyprus is working hard to resolve outstanding problems relating to the 700MHz band and include it in the auction of 5G spectrum since there is a cross-border coordination problem with a third country (Turkey). Six 2×5 MHz blocks of 700 MHz spectrum will be available. A spectrum cap has been set at 2×10 MHz. Licences will be offered with coverage obligations of 70% of the population and highways by year-end 2025. Data throughputs will have to be above 100 Mbps. The reservation price for each 2×5 MHz is set at 6 million EUR. Licences will be valid 20 years. The auction took place on 17 December 2020, after several postponements.

The winners are Cyprus Telecommunications Authority (Cyta), Primetel, Epic and Cablenet. The auction raised 41.6 million EUR for spectrum in the two bands (700 MHz and 3.5 GHz).

3.4 -3.8 GHz band

There is growing interest in the market for 5G, so in January 2019 the government gave three (3) pilot (trial) national licences in 3.4 -3.8 GHz band to the three (3) existing mobile operators, with 100 MΗz bandwidth each, in order to test the equipment and the relevant applications.

Eight 50 MHz blocks are available. A spectrum cap has been set at 100 MHz. Licences will be offered with coverage obligations of 70% of the population and highways by year-end 2025. Data throughputs will have to be above 100 Mbps. The reservation price for each 50 MHz block is set at 2.5 million EUR. Licences will be valid 20 years. The auction ended on 17 December 2020, after several postponements.

The winners are Cyprus Telecommunications Authority (Cyta), Primetel, Epic and Cablenet. The auction raised 41.6 million EUR for spectrum in the two bands (700 MHz and 3.5 GHz).

26 GHz

Cyprus is planning to also authorize this band according to the expected harmonized EU Decision.

Main points

- Implementation and Development of 5G Networks in the Czech Republic – Towards the Digital Economy” approved by the Czech government on January 13, 2020

- National Plan for the Development of Next Generation Networks 2016-2020.

- 3.7 GHz spectrum auctioned off.

- O2 Czech Republic launched 5G in July 2020

- Spectrum auctions in the 700 MHz and 3.5 GHz frequencies completed mid-November 2020 raising 5.6 billion CZK (212.9 million EUR)

- The Government of the Czech Republic adopted the National Plan for the Development of Next Generation Networks in October

- The Czech Telecommunication Office (CTU) auctioned off 3.7 GHz spectrum in 2017 to four bidders, including two new players:

- Telecom 5G: two 40 MHz blocks 3720-3760 MHz and 3760-3800 MHz

- O2 Czech Republic: one block 3680-3720 MHz

- PODA: 3640-3680 MHz

- Vodafone Czech Republic: one block 3600-3640 MHz

- Each 40 MHz block was sold for CZK 203 million (9.2 million USD), for a total of CZK 1.015 billion.

This spectrum seems to be dedicated to “Geographically localised BWA with fixed, mobile or nomadic terminals” and not 5G[2].

700 MHz / 3.4-3.6 GHz

- Consultation for the 3.4-3.6 GHz band took place from June 2018 until January 2019.

- At the beginning of 2019, CTU gave more details on the 5G auction that includes the 700 MHz and the 3.4-3.6 GHz bands for consultation until 25 January 2019. In June 2019, the CTU published the draft plan of the 700 MHz (2×30 MHz, 703–733/758–788 MHz) and 3.5 GHz bands auction (190 MHz, 3410-3600 MHz). The auction was rescheduled to April 2020, in October 2019 and was further postponed to year-end 2020 early The minimum price for individual auction blocks will be 6.3 billion CZK (240 million EUR). Terms and condition of the auction:

- Successful bidders will have to cover municipalities currently identified as white spaces.

- They must cover 95% of the population of all these communities within three years of the allocation.

- By January 2025 100% of the backbone network of railway and road corridors, and 95% of municipalities above 50,000 must be covered.

- Within ten years the winning operators must cover 99% of the population and 90% of the territory of each district of the Czech Republic.

- Consultation launched in March 2020 on a new framework for the 700 MHz and 3.4-3.6 GHz auction. The framework will include spectrum set aside for verticals and spectrum caps.

- In March 2020, the auction was delayed later in 2020 by CTU. The regulator modified rules for the 5G auction.

- 700 MHz: two blocks of paired 10 MHz of spectrum and two blocks of paired 5 MHz spectrum are available of which 2×10 MHz are reserved for new players. The minimum prices for 700 MHz blocks are set at 700 million CZK (26.8 million EUR), 1.12 billion CZK (42.8 million EUR), and 1.4 billion CZK (53.5 million EUR).

- In the 3.4-3.6 GHz, 10 blocks of 20 MHz of spectrum are available with spectrum caps for incumbents of 60 MHz and 100 MHz for new players. It also decided to provide national roaming conditions to new players in the 700 MHz and the 3.5GHz frequencies; In addition, 40 MHz of spectrum will be reserved for industry verticals (3400-3440 MHz).

- new players can buy up to 100 MHz. O2 Czech Republic launched 5G in July 2020

- The auction ended on November 13, 2020. In the 700 MHz band, O2 Czech Republic won the 2×10 MHz block with obligations to provide national roaming and PPDR services for public emergency and security The other 700 MHz 2×10 MHz blocks are acquired by T-Mobile Czech Republic and Vodafone Czech Republic. In the 3,400-3,600 MHz band, O2 Czech Republic and CentroNet gained blocks of 20 MHz connected with obligations to lease frequencies to support Industry 4.0. T-Mobile Czech Republic, Vodafone Czech Republic and Nordic Telecom 5G also won spectrum 20 MHz blocks.

- All in all, the auction raised 5.6 billion CZK (211.9 million EUR). T-Mobile Czech Republic paid 1.89 billion CZK (71.8 million EUR), Vodafone Czech Republic 1.568 billion CZK (59.6 million EUR) and O2 Czech Republic 1.342 billion CZK (51 million EUR). CentroNet was charged 628 million CZK (23.9 million EUR), and Nordic Telecom 168 million CZK (6.4 million EUR). Poda and Sev.en Innovations participated but did not acquire any spectrum. The auction included conditions to encourage the entry of new players but none of the bidders acquired enough spectrum to be operational.

26 GHz

- In August 2020, CTU launched a public consultation on draft spectrum utilisation plan for the 26 GHz band.

Main points

- 700/900 MHz auction held in March 2019

- 5G launch by TDC in September 2020, by Telenor mid-November 2020

- Multi-band auction (1500 MHz /2100 MHz/2300 MHz/3.5 GHz/26 GHz) expected in March/April 2021

The national 5G plan was published in February 2019. In March 2019, Denmark completed its auction of the 700, 900 and 2,300 MHz bands, TDC, Hi3G and TT-Netvaerket, raising total proceeds of DKK 2.21 billion (EUR 296 million). The licenses are valid from April 2020.

- Hi3G Denmark ApS won 2 x 10 MHz in the 700 MHz band and 2 x 10 MHz in the 900 MHz band at a total cost of almost 65 million EUR

- DC A/S won 2×15 MHz in the 700 MHz band, 2×10 MHz in the 900 MHz-band, 60 MHz in the 2300 MHz band and 20 MHz for SDL in the 700 MHz-band at a total cost of almost 217 million EUR

- TT-Netvaerket P/S won 2×5 MHz in the 700 MHz band and 2×10 MHz in the 900 MHz band at a total cost of 14 million EUR

In December 2019, the Danish Energy Agency has issued a consultation on spectrum for private 5G networks, particularly in the 3.5 GHz band. Responses to the consultation are asked by January 6, 2020.

Multi-band auction (1500 MHz/2100 MHz/2300 MHz/3.5 GHz/26 GHz)

On 1 February 2019 and 25 March 2020, the Minister for Climate, Energy and Utilities decided that an auction should be held of the 1500 MHz, 2100 MHz, 2300 MHz, 3.5 GHz and 26 GHz frequency bands. The auction on the 1500 MHz, 2100 MHz, 2300 MHz, 3.5 GHz and 26 GHz bands is expected to commence in March 2021. The frequencies will be awarded nationwide on a service- and technology- neutral basis.

In the 3.5 GHz frequencies, licensees will be subject to coverage obligations, or leasing obligations in the first four years of the licence period for licences in 3740-3800 MHz spectrum or usage requirements. The licensee shall install antennas as well transmitting and receiving equipment capable of using the frequencies specified in the licence not later than 31 December 2023 at a minimum of 100 mast positions. The equipment at the relevant mast positions shall be connected to the necessary telecommunications infrastructure in such a way as to enable the licensee, via the relevant mast positions, to offer at least one electronic communications service (at the licensee’s own discretion) to end-users by using the frequencies specified in the licence. The coverage obligation does not require a specific technology to be used. Licensees shall ensure:

- not later than 31 December 2023, population coverage of 60% when using the 3.5 GHz frequency band, ensure

- not later than 31 December 2025, population coverage of 75% when using the 3.5 GHz frequency

Frequencies in the 26 GHz band to be awarded in the auction comprises 2850 MHz unpaired frequencies (24.65 – 27.5 GHz). The licences are subject to usage requirements. The licensee shall install antennas as well transmitting and receiving equipment capable of using the frequencies specified in the licence not later than four years from the date of entry into force at a minimum of 100 mast positions. The equipment at the relevant mast positions shall be connected to the necessary telecommunications infrastructure in such a way as to enable the licensee, via the relevant mast positions, to offer at least one electronic communications service (at the licensee’s own discretion) to end-users by using the frequencies specified in the licence.

Main points

- 4 licences in 3.6 GHz frequencies to be assigned in 2020

- 700 MHz and 26 GHz tenders scheduled later in 2021

Estonia conducted a consultation on 5G in April 2018. The NRA, TJA, indicated in May 2018 that an auction would be organised for the 3.6 GHz band.

In January 2019, the Minister of Entrepreneurship and Information Technology signed a draft regulation setting the basis, so that electronic communications operators can start developing 5G networks in the 3.6 GHz band.

In March 2019, a 5G spectrum roadmap was issued with plans to auction 700 MHz spectrum in the first semester 2020. The potential of spectrum in the 40-44 GHz and 66-71 GHz ranges was mentioned.

The auction for 390 MHz of spectrum in the 3.6 GHz band was suspended in April 2019 following a complaint about the rules of the tender. Levikom Eesti, a provider of IoT and fixed-wireless internet services, said that auctioning only three licences in the 3.6 GHz band would favour the country’s trio of incumbent cellcos, while also hampering competition. In the first months 2020, the IT ministry decided to offer a 4th 5G licence. Applications are due by June 18th, 2020.

In October 2019 the Ministry of Economic Affairs and Communications launched a consultation about a public tender of spectrum at 700 MHz and 26 GHz (24.25–27.5 GHz) for mobile broadband services. The consultation ran until mid-December 2019.

In June 2020, a fourth licence was added in the forthcoming 5G auction.

Main points

- The 700 MHz band frequencies were assigned in November 2016.

- In May 2018, the government launched a consultation to free spectrum in the 3.6 GHz band.

- The 3.6 GHz band spectrum auctions took place in September 2018.

- Elisa, first 5G network in Europe launched in June 2018. All players launched 5G since then.

- Early award of trial licences to a large number of companies (October 2015-October 2017).

- Auction for the 26 GHz (25.1- 27.5 GHz) spectrum ended on June 8, 2020. The incumbent MNOs each got a 5G licence at 7 MEUR giving them the right to use 800 MHz of spectrum.

5G Test Network Finland (5GTNF) is a consortium of industrial partners, research organisations and the public sector (including vendors Nokia and Ericsson, MNOs Telia, DNA and Elisa, Finnish Transport and Communication Agency Traficom, Business Finland, a large amount of Finnish ICT-companies, universities and research institutes) providing a leading edge environment to develop 5G and beyond, AI and cybersecurity based vertical industry solutions, services, systems and products. The realistic telecom technology test environment serves a large number of research projects and trials based on real vertical system and service needs and requirements. The multisite test environment and co-operation network is supporting 5G and beyond technologies and service research and large-scale field trials. The local test sites are in Espoo, Helsinki, Oulu, Tampere, Turku, Ylivieska, Sodankylä and Kuopio.

At the end of 2018, the Finnish Ministry of Transport and Communications has published a new strategy for digital infrastructure called “Turning Finland into the world leader in communications networks – Digital infrastructure strategy 2025”. It details the strategy for promoting the implementation of 5G and supporting optical fibre construction in Finland. The strategy contains Finland’s 5G deployment plan and deals especially with the 3.6 GHz and 26 GHz bands.

In January 2020, Finland launched a consultation on the 26 GHz auction scheduled in summer 2020. It included spectrum from 25.1 to 27.5 GHz excluding the lowest 850 MHz part of the 26 GHz band that was reserved for local 5G networks and research & development or educational usage. The auction took place on June 8th, 2020, and the current MNOs – Elisa, Telia and DNA – were each assigned 800 MHz of spectrum at the starting price of 7 million EUR. Licences are national for mainland Finland. Elisa won the 25.1-25.9 GHz frequencies, Telia the 25.9-26.7 GHz and DNA got the 26.7-27.5 GHz frequencies. The frequency band can be used for 5G networks as of 1 July 2020 and the licence is valid in mainland Finland until 31 December 2033.

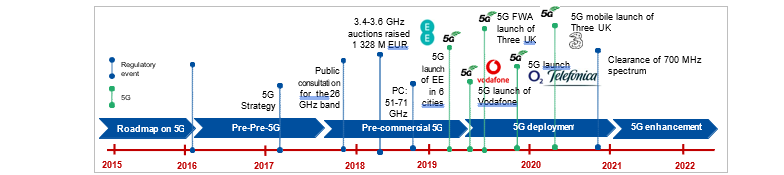

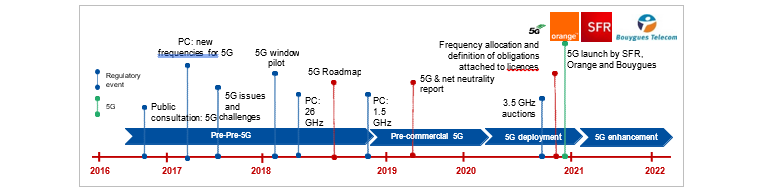

Main points

- 5G launch by SFR in November 2020, by Bouygues Telecom and Orange France in December 2020

- 700 MHz frequencies assigned in December

- Consultation on 5G,

- Trial licences and trial cities, 2017-2020

- 5G pilot window, Jan.

- Provision of mid-band spectrum for trials in selected

- 5G roadmap, July

- 5 GHz auction completed on October 1st, 2020. Results of the positioning auction published on October 20th, 2020.

The 5G road began in 2016 when ARCEP launched a public consultation on 5G. The process accelerated in 2017 when ARCEP consulted on its 5G roadmap and awarded trial licences.

- In March 2017, ARCEP published a report in “5G: Issues and Challenges”

- In January 2017, ARCEP launched a public consultation on “New frequencies for the regions, businesses 5G and innovation”.

- Creation of a 5G pilot window 5G@arcep.fr in January 2018. ARCEP opened a 5G pilot window for assigning frequencies to stakeholders wanting to perform full-scale 5G pilot trials (ports, hospitals, connected roadways…).

- On May 22nd, 2018, ARCEP launched a public consultation on making the pioneer 26 GHz band available to kick-start 5G rollouts. It ran until 18 June 2018.

- 5G trial authorisations in many cities in 3.5 and 26 GHz frequencies. Ongoing and completed trials (when mentioned) include: Marseille (Orange), Lille/Douai (Orange), Sophia-Antipolis, Chatillon (Orange ended), Linas, Pau, Paris (Ericsson ended, SFR ended, Bouygues Telecom ended, SFR, Orange), Sophia-Antipolis (Orange-EDF-Eurecom ended), Vélizy (Bouygues Telecom ended, SFR), Linas-Monthléry (Bouygues Telecom, Orange), Bordeaux Mérignac (Bouygues Telecom ended, Bouygues Telecom), Nantes ( SFR ended), Lyon (SFR ended, Bouygues Telecom), Pau (Orange ended), Toulouse (SFF-Airbus ended), Grenoble (CEA-Leti), Saint Denis (Orange), Cesson-Sévigné (b<>com ended), Lannion (b<>comn ended), Nozay (Nokia ended), Cesson-Sévigné, Saint Maurice de Rémens (Bouygues Telecom), Toulouse-Francazal (SFR), Ouistreham (CEA Leti).

- Mid-July 2018, ARCEP disclosed the French 5G roadmap and announced the launch of four priority areas:

- Free up and assign 5G spectrum; ARCEP is currently working hard on future connectivity needs and on freeing-up and awarding 3.4-3.8 GHz spectrum

- Facilitate development of new uses and applications

- Support deployment of new infrastructures

- Ensure transparency and discussion on 5G deployments and on public exposure

- Public consultation on the 1.5 GHz band was opened between July 30th and September 30th, 2018.

- Public consultation on award procedures, procedures sequencing and on requirements was opened between October 26th and December 19th, 2018 to collect ideas and needs from operators, local authorities, vertical market players, economic stakeholders and all interested parties. ARCEP will be holding a second consultation on the call or calls to tender, which it will then propose to the Government. The call for tenders was expected by year end 2019.

- In February 2019, the French government and the national regulatory authority, ARCEP, issued a call for 5G trials in the 26 GHz frequency band in France.

- ARCEP issued a consultation on planned continued use of the 3.4-3.8 GHz band for wireless local loop services in May 2019.

- In July 2019, ARCEP opened a public consultation on the terms and conditions for the allocation of 5G spectrum in the 3.4GHz-3.8GHz band[1]. The regulator is planning to release 31 TDD blocks (10MHz each) in the 3490MHz-3800MHz band. The procedure will include a first stage, in which operators can obtain frequency blocks for optional commitments, before a second stage (auction), which will allow candidates to obtain additional frequencies. Each bidder will be allowed to purchase a maximum of 100MHz. Operators could be obliged to offer 5G in at least two cities before the end of 2020. The obligations to support the deployment of 5G equipment are the following: 3,000 sites by 2022, 8,000 (2024) and 12,000 (2025).

- In September 2019, the head of French regulator ARCEP suggested that the country may opt for a sharing regime in the 26 GHz band, in which verticals will be able to gain access to spectrum.

- Late in November 2019, reserve prices were disclosed for the mid-band frequency assignment procedure. Up to four 50 MHz lots will be assigned on demand at 350 MEUR each and up to eleven 10 MHz lots will be auctioned with a 70 MEUR reserve price.

- In December 2019, ARCEP issued a consultation about plans to award the 700 MHz in Reunion and Mayotte, and the 3.4-3.8 GHz band in Mayotte, during 2020.

- The four bidders for 5G spectrum in mainland France have been revealed late in February 2020: Bouygues Telecom, Free Mobile, Orange and Altice requested the allocation of one of the four 50MHz blocks awarded in exchange for optional commitments.

- In April 2020, the 3.5 GHz auction was postponed from April 2020 due to covid-19. In June 2020, Arcep announced the auction will take place at the end of September (Sept. 20 to 30). The auction for eleven 10 MHz blocks started on September 29, 2020. The first round (bidding) was completed on October 1st, 2020. The four MNOs paid a total of 2.786 billion EUR for 310 MHz of spectrum, in addition to the previous 50 MHz block awarded earlier in 2020 to each player at 350 million EUR per block. Orange won 90 MHz of spectrum, SFR obtained 80 MHz and both Bouygues and Free got 70 MHz of spectrum. A spectrum cap had been set at 100 MHz of spectrum per MNO. The second round where players bid for “positioning” that spectrum in the band ended on October 20th, 2020. Allocations are as follows:

- SFR : 3490-3570 MHz

- Bouygues Telecom : 3570-3640 MHz

- Free Mobile : 3640-3710 MHz

- Orange : 3710-3800 MHz

- In October 2020, Bouygues Telecom filed an appeal against French legislation forcing the MNO to remove non-compliant

- In December 2020, Arcep issued a consultation (18 December 2020-26 Feburary 2021) on draft procedures for 700 MHz and 3.4-3.8 GHz frequencies in La Reunion and in 700 and 900 MHz frequencies in Mayotte.

Other public initiatives

The other public initiatives aim to create appropriate ecosystem in the country to create a dynamic buoyant ecosystem favorable to innovation:

- The initiative “La French tech”

- The initiative “France Très Haut Débit” (Optic Fiber)

- The programme “Nouvelle France Industrielle” (New Industrial France) created in October 2013 by French government to boost productivity and investments in 34 industrial sectors. The initial budget of 3.7 billion EUR. The programme gathers industrial players, public institutions, competition committees, operators, and well-established research organizations for 13 priority actions where fiber broadband and 5G are key elements.

In February 2019, the French government and the national regulatory authority, Arcep, issued a call for 5G trials in the 26 GHz frequency band in France. In October 2019, ARCEP announced that eleven players had been selected to carry out trials in the 26 GHz band.

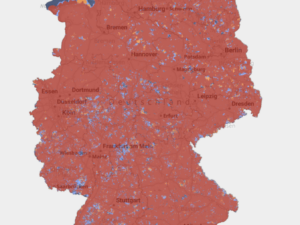

Main points

- The 700 MHz frequencies assigned in June 2015.

- “5G for Germany”, autumn 2016.

- 5G spectrum roadmap, 2018.

- Final conditions for 5G Auction, November 2018.

- 4-3.7 GHz (300 MHz) and 2 GHz (2×60 MHz) 5G auction ended in June 2019 raising 6.55 billion EUR (of which 4.18 billion EUR for 36 GHz spectrum). Licences include coverage obligations.

- 100 MHz reserved for local and regional purposes in 3.7-3.8 GHz spectrum. Applications opened on November 21st, 2019.

- 26 GHz spectrum expected to be potentially awarded upon application.

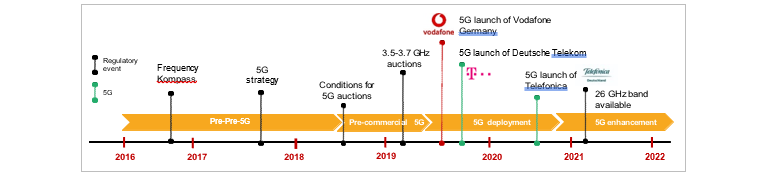

- Vodafone and Deutsche Telekom launched 5G in July 2019, Telefonica in October 2020. The new player 1&1 Drillisch has not launched 5G yet.

5G initiatives

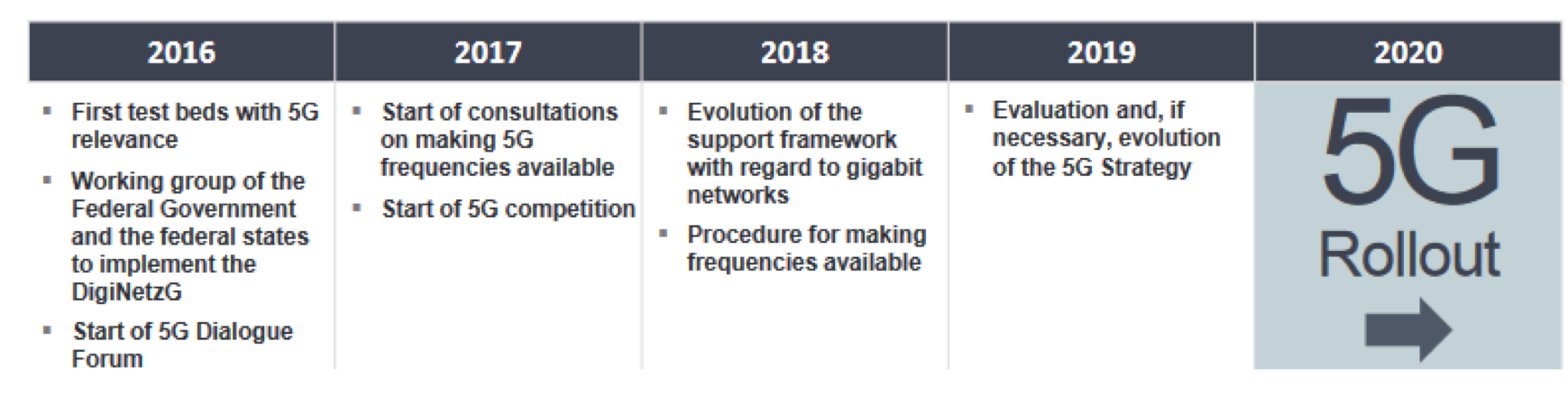

The Bundesnetzagentur published its “Frequency Compass” in July 2016 in a view to identify areas for regulatory action on spectrum for 5G. More detailed Points of Orientation were published in December 2016.

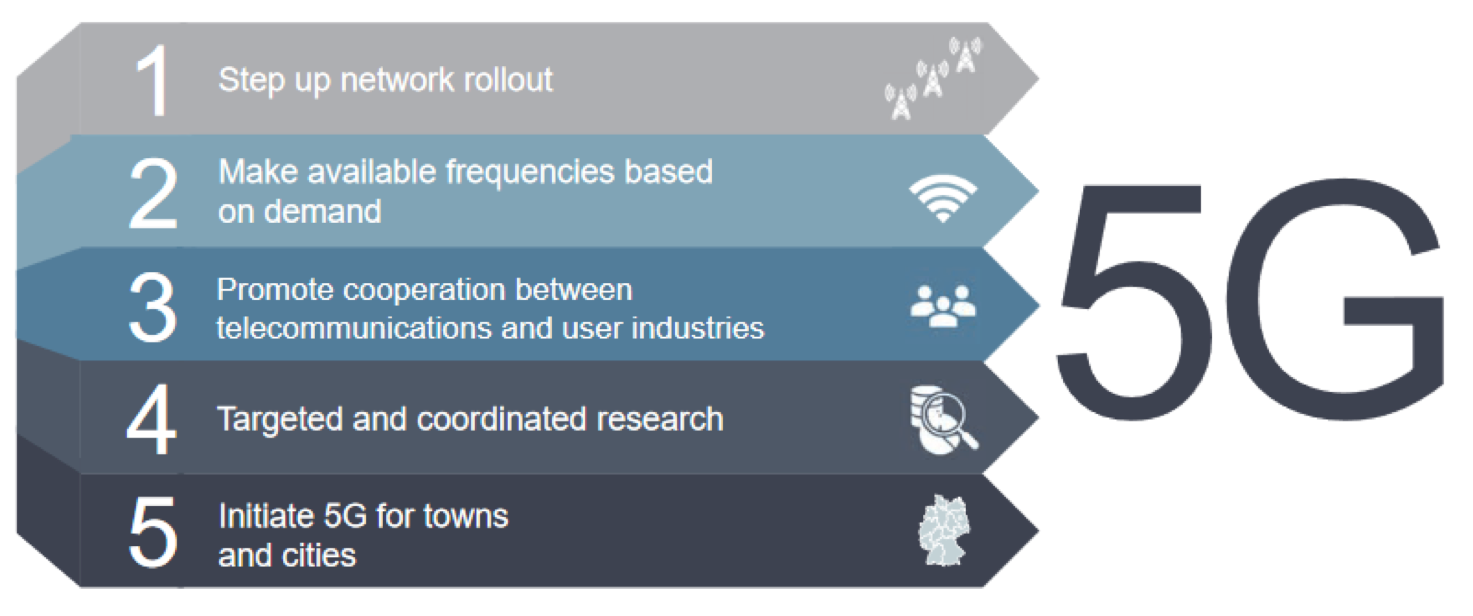

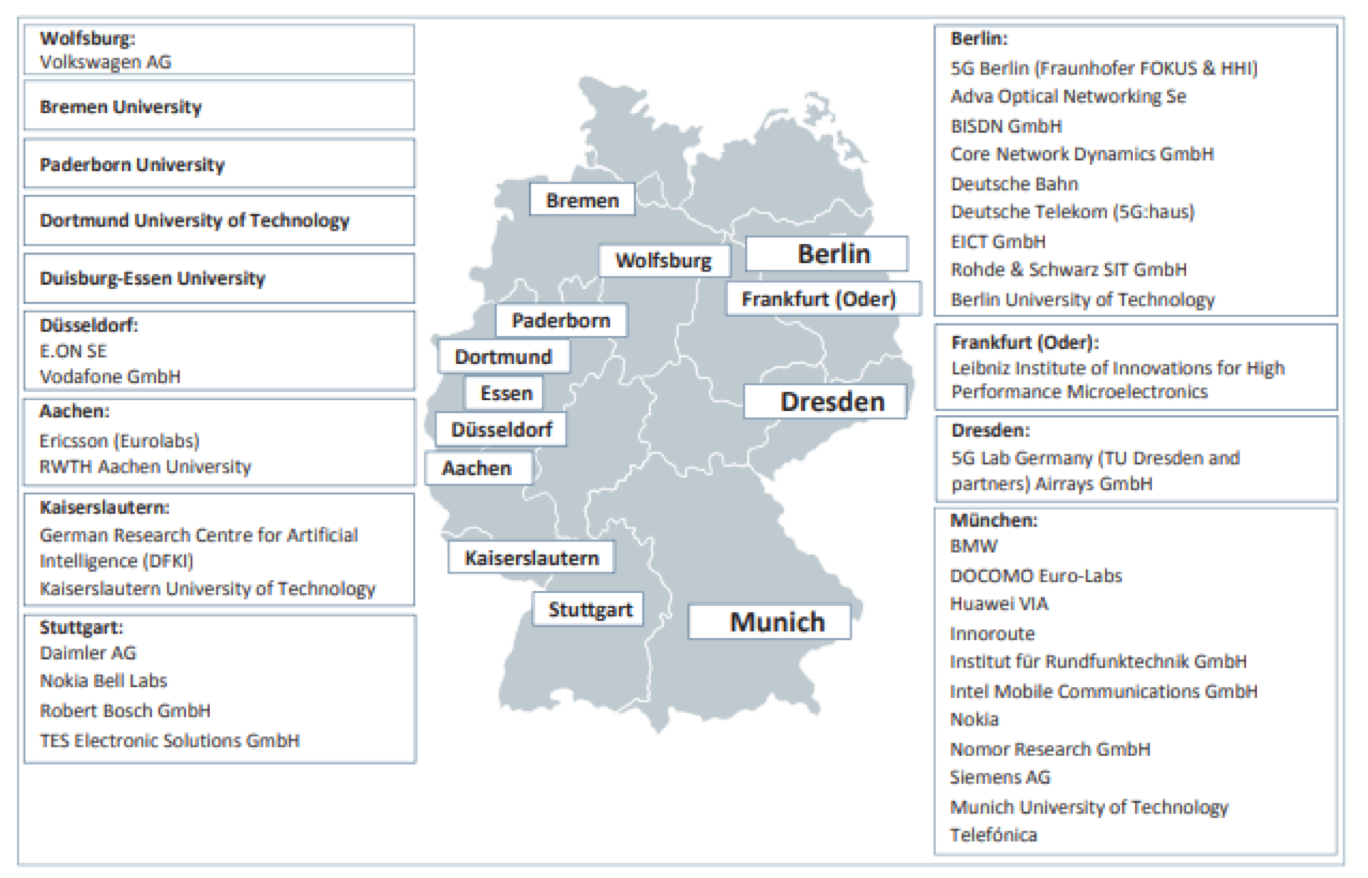

The Government launched in autumn 2016 its “5G Initiative for Germany”. In a paper released in September 2017, the Federal Government describes the national 5G strategy (context, actions, rollouts) over the period to 2025. It defines five field of actions, key milestones and allocates 80 MEUR to 5G research initiatives in 5G research centres:

Based on the submitted views, the German NRA released key elements and launched a formal demand for nationwide assignments in the 2 GHz and 3.6 GHz bands in June 2017.

In January 2018, the German NRA released a draft consultation setting out that scarce spectrum in the 2 and 3.6 GHz bands would be auctioned. Decisions I and II were published in May 2018.

- In the 2 GHz band, 2×40 MHz will be made available as from 1st, January 2021. An additional 2×20 MHz will be available as from 1st January 2026.

In the 3.6 GHz band (3.4-3.7 GHz), some of the spectrum is assigned de facto on a nationwide basis (until 2021/2022) will be available as from 1st January 2022 (earlier stage as from 2019). Other public initiatives award conditions and auctions rules for 5G were released on November 26th, 2018.

The 5G spectrum auctions begun spring 2019. The qualification procedure was open from November 26th, 2018 until January 25th, 2019. Coverage conditions have been strengthened while the 5G timetable seems to have been softened. Conditions are set in two stages (2022 and 2024). BNetzA should now prepare the application process for the verticals (mainly industrial sites) for the upper 100 MHz of 3.6 GHz (3.7-3.8 GHz) within a few weeks.

The final draft conditions require minimum data rates of 100 Mbps available by the end of 2022 in 98% of households in each state, all federal highways, and all main roads and along the major railway routes. The regulator said that the minimum coverage rules will not be applicable to any new entrant. Bundesnetzagentur’s document also includes expectation that operators would work together on providing coverage in areas not economically viable for each to install their own equipment.

Coverage requirements:

- At least 100 Mbit/s for at least 98% of households in each federal state by the end of 2022,

- At least 100 Mbit/s and a maximum latency of 10 ms for all German motorways by the end of 2022

- At least 100 Mbit/s and a maximum latency of 10 ms for all federal roads with connectivity function levels 0 or 1 by the end of 2022,

- Of at least 100 Mbit/s and a maximum latency of 10 ms for all other federal roads by the end of 2024,

- At least 50 Mbit/s for all state roads by the end of 2024

- At least 50 Mbit/s for seaports and the inland waterways core network by the end of 2024

- At least 100 Mbit/s for rail routes with more than 2,000 passengers daily by the end of 2022, at least 50 Mbit/s for all other rail routes by the end of 2024,

- And, by the end of 2022:

- Operation of 1,000 “5G base stations”, and

- Operation of 500 base stations with a transmission rate of at least 100 Mbit/s in not-spots.

The 3.6 GHz band auctions started in March 2019. On June 5, 2019, the regulator ramped up minimum bids in an attempt to wrap up the 5G spectrum auction. The process ended on June 12, 2019 raising 6.55 billion EUR after 497 rounds. Deutsche Telekom bid 2.17 billion EUR for 130 MHz of the 420 MHz of spectrum allocated in the 2 and 3.6 GHz frequencies. Vodafone got 130 MHz for 1.88 billion EUR and Telefonica got 90 MHz for 1.42 billion EUR. Drillisch paid 1.07 billion EUR for 70 MHz. Frequencies will be available as from 2021 or 2026.

The Minister for transport and digital infrastructure in Germany updated the national mobile strategy in September 2019. A 5-point plan was announced and a 1.1 billion EUR plan to improve mobile coverage was agreed. The central topic raised deals with coverage issues (extending coverage) and especially with ways and means to reduce white spots in 4G and consequently in 5G.

National mobile operators agreed to i)provide reliable voice and data services in 99% of households nationwide by the end of 2020, and 99% of households in each state by 2021, especially in rural areas, ii)increase intra-cooperation and build at least 1,400 masts accessible to any operator, iii) meet a minimum of 100 Mbps speeds across major transport routes, iv)and install base stations in “white spots” unserved rural areas. Dedicated funds for Municipalities will be opened to help them actively contribute to improve mobile coverage. MNOs agreed to share 6,000 5G sites in rural areas and in transportation.

In the plan to counter the economic crisis caused by the covid-19, the German government decided to allocate 7 billion EUR to 5G.

Main points

- Trial licences in 3.4-3.8 GHz frequencies issued

- 5G cross-border corridor (Bulgaria, Greece, Serbia).

- Auction of 2×30 MHz in the 700 MHz band, 2×15 MHz in the 2100 MHz band (plus 2×45 MHz in the same band which is already allocated but licences expire in 2021), 280 MHz at 6 GHz, and up to 2,500 MHz in the 24 GHz – 28 GHz range completed on December 17, 2020.

- Vodafone expected to launch 5G in the first quarter 2021, following the spectrum auction

In July 2018, Bulgaria, Greece and Serbia signed an agreement to develop an experimental 5G cross- border corridor (Thessaloniki – Sofia – Belgrade) that will test autonomous vehicles.

In October 2018, EETT launched a consultation on the granting of rights to use spectrum between 3400–3800 MHz and 24.25–27.5 GHz bands for 5G testing.

In January 2019, the Hellenic Telecommunications and Post Commission (EETT) issued the Technical Announcement entitled “Review of Frequency Bands for the Deployment of 5G Networks” aiming to inform all interested parties (incumbent and new providers of electronic communication networks, equipment manufacturers, radio-spectrum users in general, verticals) with respect to the radio frequency bands that are currently under review by EETT and are expected to be used for the deployment of fifth generation (5G) wireless broadband networks in the near future, taking also into consideration the relevant developments at a European level.

Late in January 2019, EETT issued a public consultation on the potential issuance of mobile licences for the 1500 MHz band.

Multi-band auction incl. 700 MHz, 3.4-3.8 GHz and 26 GHz spectrum

In March 2018, the EETT announced the results of its public consultation on the award of spectrum in the 3400-3800 MHz band for 4G/5G use.

In October 2019, the auction for 3.5 GHz spectrum was postponed to the end of 2020. In January 2020, EETT issued another consultation on the multi-band spectrum auction (2×30 MHz in the 700 MHz band, 2×15 MHz in the 2.1 GHz band, 280 MHz at 3.7 GHz and up to 2500 MHz in 26 GHz spectrum depending on spectrum demand). The consultation which closed on April 30, 2020 was about alternative ways of assigning the band. The government still expects to proceed with the multi-band auction by year-end 2020. Late in September 2020, EETT the Greek regulator kicked off the 5G auction process and invited applications for spectrum until 23 October 2020.

It published tender documents for all pioneer bands in September 2020. Licences in all pioneer bands will be valid for 15+5 years from December 20, 2020 till December 19, 2035 (except specific slots at 3.4-3.8 GHz which will be valid from May 1st, 2029). Licences in 700 MHz and 3.4-3.8 GHz include coverage obligations. The starting price for all the frequencies was 367.3 million EUR. The three MNOs submitted bids by the October 30, 2020 deadline. The auction raised 372.3 million EUR. Vodafone paid 130.1 million EUR in total: 37.5 million EUR for 14 blocks in 3400-3800 MHz frequencies, 51.1 million EUR for 2 blocks in 700 MHz frequencies, 6.5 million EUR for 2 blocks in 26 GHz spectrum and 35.1 million EUR for 4 blocks in 2 GHz band. Cosmote spent 123 million EUR: 15 blocks at 3.4GHz to 3.8GHz for 30.7 million EUR, 50.6 million EUR for 2 blocks at 700 MHz, 4 blocks at 2 GHz for 35.27 million EUR and 2 blocks in 26 GHz frequencies for 6.5 million EUR. The third player, Wind Hellas, committed 119 million EUR for 10 blocks at 3.4-3.8 GHz for 30.3 million EUR, 2 blocks in 700 MHz spectrum for 5.1 million EUR and 1 in 26 GHz band for 3.245 million EUR.

- The 3.4-3.8 GHz licence holder has to cover:

- 20% of the population and deploy its network in at least two districts within 3 years,

- Install at least 300 5G sites within 5 years

- Provide at least 100 Mbps speeds with a maximum 10 ms latency

- Within 3 years in most major continental motorways and on the major road north of Crete

- Within 6 years in all Greek motorways

- Licensees at 700 MHz have to cover

- Within 3 years: at least 99% of population at country level and 95% of population in each district, at least 95% of territory and maritime zones, 95% of motorways, 95% of railway networks (Athens-Patras and Athens-Thessaloniki (excluding tunnels)

- At least provide 100 Mbps DL with a maximum latency of 10 ms and within 3 years to at least 60% of the population, 60% of motorways and rail networks (Athens-Patras and Athens- Thessaloniki (excluding tunnels) and 95% of major motorways (Athens-Thessaloniki-Evzoni, Peloponnese, Olympia-Odos, Ionian main road, Egnatia-Odos, Central Greece main road, Attiki-Odos, Northern Cretan main road

- At least provide 100 Mbps DL with a maximum latency of 10 ms and within 6 years to at least 90% of the population, 90% of motorways and rail networks

- At least provide 100 Mbps to 90% of the population living in underserved areas within 5 years If the licensee is a new player, coverage obligations are less strict: it has to cover at least 80% of the population within 5 years.

“Digital Success Programme 2.0”. Strategic study.

European 5G hub for 5G.

- 700 MHz/2100 MHz/2600 MHz/3600 MHz auction ended end March 2020.

3.6 GHz auction scheduled for September 2019

In July 2017, the domestic Government stated three major objectives for Hungary in its “Digital Success Programme 2.0”. Strategic study.

- Hungary to become a European hub for 5G developments by 2018

- Hungary to play a leading regional role in testing applications based on 5G technology

- Hungary to be among the first to adopt 5G technology after 2020.

The 5G coalition with up to 50 Hungarian government institutions, companies, business chambers, universities, research institutes and professional and civic organisations was formed mid-June 2017. The 5G Coalition set goals including drawing up a 5G development strategy and creating a testing environment to give Hungary a say in setting global 5G standards, aiming for the nation to become an early 5G adopter from 2020.

The NMHH issued a public consultation in June 2019 (comments expected by July 8, 2019) on its plans to auction 700 MHz, 2.1 GHz, 2.6 GHz and 3.6 GHz. The auction was expected late in 2019 but as the consultation showed limited market demand, it should be held in 2020. Four MNOs have applied for the auction on 8 August 2019 and after the formal review the Authority entered three operators only (Magyar Telecom, Telenor and Vodafone). Digi Communications appealed the decision of the NMHH. The decision was upheld late in November 2019.

The multi-band auction was held at the end of March 2020 despite covid-19. 50 MHz was sold in the 700 MHz band (expected to be freed up on 6 September 2020), 30 MHz in the 2100 MHz band and 310 MHz in the 3600 MHz frequencies. No bids were submitted for the 2600 MHz spectrum. Magyar Telecom, Vodafone Hungary and Telenor Hungary won 15-year licences (until 2035, licences can be extended for 5 additional years once with the same pricing conditions) in the 700 MHz, 2100 MHz and 3600 MHz bands and acquired usage rights for 128.49 billion HUF (368 million EUR). DIGI did not take part in the auction. Its licence bidding application was rejected earlier in September 2019 by the Hungarian regulator NMHH. The player which protested against its exclusion lost legal action in November 2020.

26 GHz band

- Intensive fixed service use currently in 24.5-26.5 GHz sub-band.

- Expiry date of most of the licenses is 2027.

- Negotiation with present frequency users is ongoing.

- 26.5-27.5 GHz sub-band suitable for early introduction of 5G

- Strategy for implementing new technical criteria for the introduction of 5G is under elaboration and the rules for the transition period are to be developed.

- The Authority also considers 26 GHz spectrum for 5G. However, due to lack of demand on that specific band (Public consultation held on that topic during Summer 2019), plans are on hold

Main points

- National Roadmap on the use of 700 MHz frequencies published on March 2019, revised on May 2020

- 6 GHz licences auctioned by ComReg in May-June 2017

- On-going preparation of the multi-band auction for 700 MHz, 2100 MHz, 2300 MHz and 2600 MHz spectrum. Final decision expected in Q4 2020.

- Temporary licenses issued to players from April to July 2020 in 700 and 2100 MHz spectrum

- 5G launch by Vodafone in August 2019,by Eir in October 2019 and by Three Ireland late in September 2020

- In May 2020, ComReg conducted tests at 20 5G antennas and concluded there were no health risks.

3.4-3.8 GHz band

360 MHz of TDD spectrum has already been auctioned in 2017. Licences for 5G services started in January 2019 and will expire on 31 July 2032 (fifteen years).

“The Auction resulted in the successful assignment of all 360 MHz of TDD spectrum. The Auction offered this spectrum in 594 lots spread over nine geographic regions (four rural and five urban) and is assigned on a contiguous basis.” (Source: ComReg)

- Imagine Communications Ireland Ltd (Imagine), currently the largest Wireless Internet Service Provider (WISP) obtained spectrum rights of use for 60 MHz in each of the rural regions;

- Airspan Spectrum Holdings Ltd (Airspan), a new entrant and the UK arm of a US global provider of 4G broadband wireless systems and solutions. Airspan’s products serve operators and markets such as smart utilities, transportation and public safety in both licenced and licence exempt frequency bands. Airspan obtained spectrum rights of use for 25 MHz in the rural regions and 60 MHz in the cities;

- Vodafone Ireland Ltd, a mobile network operator obtained 85 MHz in rural regions and 105 MHz in the cities;

- Three Ireland Hutchison Ltd, obtained 100 MHz nationally;

- Meteor Mobile Communications Ltd, obtained 80 MHz in the rural regions and 85 MHz in the cities.

700 MHz, 2.1/2.3/2.6 GHz bands

From June 2019 to July 30, 2019, ComReg issued a consultation the 700 MHz, 2.1 GHz, 2.3 GHz, and 2.6 GHz bands.

It proposes to attach “precautionary” coverage obligations to the 700 MHz band. ComReg proposes to use a combinatorial clock auction.

Due to covid-19, ComReg issued on-demand temporary licenses to MNOs in April 2020. Meteor Mobile, Three Ireland and Vodafone Ireland received temporary licenses valid from April to July 2020 in 700 and 2100 MHz spectrum.

On 13 May 2020, ComReg published a Draft Information Memorandum and Draft Regulations on the multi-band auction. Comments due by 24 June 2020 will be published by the end of June 2020. Final decision is expected in Q4 2020.

The 700 MHz band should be auctioned early 2021.

26 GHz bands (24.745 – 25.277 GHz paired with 25.753 GHz – 26.285 GHz)

The 26 GHz auction took place from April to June 2018. 840 MHz or 15 of 19 Lots of 2 × 28 MHz in the range 24.745 – 25.277 GHz paired with 25.753 GHz – 26.285 GHz was auctioned to the three mobile players in place. Each mobile player got 280 MHz. Vodafone paid 550,000 EUR while Three and Meteor Mobile paid 350,000 EUR.

It consisted of a “sealed bid combinatorial auction” using a second price rule and applying processes and rules as set out in the Information Memorandum. Winning Bidders will pay approximately 5 million EUR for spectrum rights of use, comprising 1.25 million EUR in upfront fees of 3.75 million EUR in spectrum usage fees which will be paid over the 10-year duration of the licences.

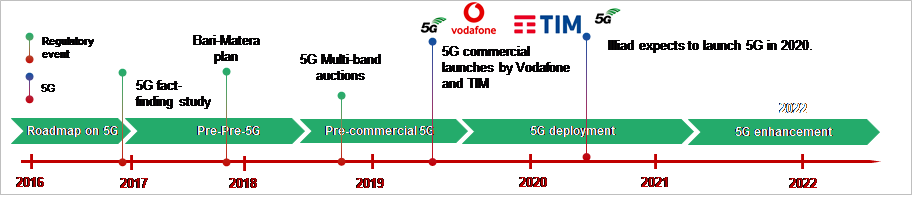

Main points

• 5G for Italy, 2016, 5G strategy, pushed by TIM, around identified cities and application areas.

• Trial licences and trial cities, mid-2017.

• 700 MHz/3.5 GHz auctions in October 2018, 26 GHz spectrum auctions, October 2018, first in Europe. Licences valid till year-end 2037.

• Launch of Vodafone and TIM 5G services in June 2019, Vodafone in August 2019, Wind Tre in October 2020 and Iliad in December 2020.

The Italian 5G strategy kick-started late in 2016 when the domestic NRA announced the start of a fact-finding survey for the development of mobile and wireless systems towards the 5G and the utilization of the spectrum above 6 GHz.

In March 2017, the Government selected five 5G trial cities, including Milan (Vodafone), Prato (Wind Tre-Open Fiber), L’Aquila (Wind Tre-Open Fiber), Bari and Matera (Telecom Italia-Fastweb-Huawei Technologies), that will use 100 MHz of 3.6-3.8 GHz spectrum. Provisional licences are valid from September 2017 to 2020.

At year-end 2017, the “Bari-Matera plan” involving MNOs, cities, research centers and equipment vendors was unveiled and began. The 60 MEUR over four years (2018-2021) plan gathers 55 partners including seven universities and research centers, public interest communities, vertical leaders, start-ups and telecom players (TIM, Fastweb, Huawei). The plan focuses on ten application areas including media/virtual reality, smart port, smart city, smart agriculture, public safety, industry 4.0, health 5.0, road safety, tourism and culture, and environmental monitoring over 70 use cases.

In May 2018, the NRA announced 5G multi-band spectrum auctions (in the 700 MHz, 3.6-3.8 GHz and 26 GHz bands). 700 MHz and 26 GHz spectrum auctions ended respectively in September and October 2018. The five 26 lots of 26 GHz spectrum raised 167.3 million EUR. 700 MHz frequencies raised globally 2.04 billion EUR. The 3.6-3.8 GHz spectrum auction hit over 4 billion EUR.

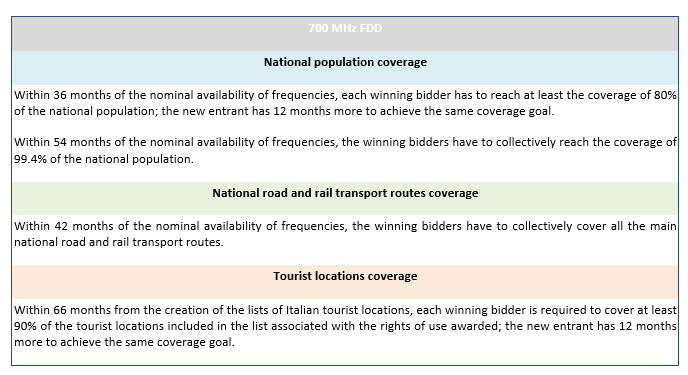

Coverage obligations

To ensure widespread improvements in mobile coverage across the Italy, the Ministry of Economic Development, based on the national regulatory authority (AGCOM) rules, has established coverage obligations for the 700 MHz FDD band and 3600-3800 MHz band.

Concerning the 700 MHz FDD band, the coverage obligations will require winning bidders to roll out improved mobile coverage of national population, tourist locations and main national road and rail transport routes.

Concerning the 3600-3800 MHz band, the coverage obligations require 80 MHz winning bidders to roll out improved mobile coverage in a mandatory list of municipalities. Within 90 days from the date of the award, the winning bidders have to submit a list of municipalities to be covered to the Ministry of Economic Development. Then, the winning bidders have 72 months from the date of the award to prove they are ready to provide on demand the 5G service in all municipalities of their mandatory list. The mandatory list has to include at least 10% of all Italian municipalities under 5.000 inhabitants. All Italian municipalities under 5.000 inhabitants out the mandatory lists are signed in a free list. Any subject, which is not an TLC operator, from 120 days from the award can declare to the Ministry its willingness to offer the service in a municipalities of free list, using leasing contract with 3600-3800 MHz winning bidders.

Finally concerning the 3600-3800 MHz band, the coverage obligations require 20 MHz winning bidders to reach the coverage of 5% of the population of each Italian region.

In September-October 2018, the NRA auctioned 60 MHz of 700 MHz spectrum for 2 billion EUR, 200 MHz of 3.6-3.8 GHz spectrum for 4 billion EUR and 1,000 MHz of 26 GHz for 167 million EUR.

- Globally 1,275 MHz are offered for sale broken down into 700 MHz frequencies (75 MHz), all the upper part of the 3.4-3.8 GHz frequencies (200 MHz divided in two blocks of 80 MHz and two blocks of 20 MHz in 3.6-3.8 GHz) and all the upper part of 26 GHz frequencies (1 GHz divided in five 200 MHz blocks in 26.5-27.5 GHz).

- Telecom Italia, Wind, Tre, Vodafone, Illiad and Fastweb submitted bids for about 2.48 billion EUR, in line with the government’s expectations (2.5 billion EUR). As a new player, Illiad was allowed to bid for a reserve package of up to three blocks in 700 MHz frequencies worth of 676.5 million EUR.

- The process started mid-September and ended on October 2nd, 2018. The whole auction ended after 14 days of intense bidding, far above expectations, reaching 6.55 billion EUR of which 4 billion EUR for the highly-coveted mid-frequencies.

- The 700 MHz auction process ended mid-September 2018. 700 MHz frequencies raised globally 2.04 billion EUR. Telecom Italia announced it had paid 680.2 million EUR for 2×10 MHz. Illiad paid 676.5 million EUR for 2×10 MHz. Vodafone spent 683.2 million EUR for 2×10 MHz. Licenses are valid 15 years, starting in 2022.

- The mid-band auction ended on October 2nd, 2018, 14 days after start and 171 rounds. Telecom Italia and Vodafone won the largest blocks of spectrum (80 MHz each) for approx.1.7 billion EUR each. Respectively they paid 1.694 billion EUR and 1.685 billion EUR. Wind and Iliad paid 483.9 million EUR each for 20 MHz of spectrum each (483.92 million EUR for Wind and 483.9 million EUR for Illiad). Overall, the 3.7 GHz auction hit over 4 billion EUR reaching 4.3 billion EUR. The average price of spectrum closed at 18 cEUR/MHz/PoP/10 years significantly higher than in the UK or in Spain.

- The auction for 26 GHz frequencies have not shown a huge interest by players. The five lots were allocated, raising a total of 167.3 million EUR. Telecom Italia paid its lot 33 million EUR, Illiad received another lot for a little less at 32.9 million EUR, while Fastweb, Wind and Vodafone paid 32.6 million EUR each.

- TIM Italy and Vodafone have agreed on a passive network sharing deal for 5G including all 22,000 antenna sites controlled by the operators.

- In February 2020, Agcom opened a procedure to evaluate coverage obligations for the 5G network sharing venture involving Wind Tre and Fastweb in the 3.7GHz concession. Wind Tre must offer coverage of at least 5% of the population of each Italian region within 48 months from the award of the license. The regulator wants to know whether these coverage obligations should be modified based on the infrastructure sharing deal signed by the two operators in June 2019.

Main points

- On-going preparation of 700 MHz spectrum assignment for 5G

- On-going preparation of 1500 MHz spectrum assignment for 5G

- 100 MHz of 3.5 GHz spectrum for 5G auctioned in November 2017. Remaining 50 MHz of 3.5 GHz spectrum for 5G auctioned in September 2018

- 5G launch by Tele2 in two sites in January 2020

700 MHz

The Latvian regulator issued a consultation on 700 MHz spectrum assignment for 5G in March 2020. Three lots of 2×10 MHz +1×5 MHz of spectrum (703-713 MHz, 738-743 MHz and 758-768 MHz – 713- 723 MHz, 743-748 MHz and 768-778 MHz – 723-733 MHz, 748-758 MHz and 778-788 MHz) are expected to be assigned. The reserve price is set at 1 MEUR for each lot. Licences would be valid for 20 years from the beginning of 2022. The consultation was opened till May 25, 2020.

1500 MHz

At the beginning of 2019, SRPK cancelled Lattetelecom’s rights of fixed use of 1427-1452 and 1492-1517 MHz frequencies as from 2021. SRPK intends to provide mobile 5G services in 1427-1517 MHz frequencies.

In August 2019, Latvia’s regulator issued a consultation on its plans to auction the 1432 – 1492 MHz band before January 2021. The consultation was closed on September 4, 2019. The auction is expected to take place in early January 2021.

3.4-3.8 GHz

100 MHz of 3.4-3.8 GHz frequencies partially auctioned off in November 2017. LMT obtained the two 50 MHz blocks (3400 MHz-3450 MHz and 3650 MHz-3700 MHz) for the reserve price of 250,000 EUR a piece. The concessions are valid for 10 years, from January 2019 to December 2028.

Remaining 50 MHz of 3.5 GHz spectrum auctioned off in September 2018. SPRK auctioned off 50 MHz of spectrum for 5G services at 3550-3600 MHz to Tele2 Latvia in September 2018. The auction raised 6.5 million EUR for a 10-year licence valid from January 1st, 2019.

Main points

- General plan for 5G approved on June 3, 2020, including coverage obligations: at least one of the 5 largest cities covered by 2022, all 5 by 2023 and main routes by 2025

- 3.4-3.8 GHz frequencies assignment expected in Q1 2021 (temporary trials allowed in the band)

- 700 MHz frequencies assignment expected in 2021

- 26 GHz spectrum will be assigned when three will be enough demand

700 MHz

The regulator plans to assign one 2 x 10 MHz lot of FDD spectrum, two 2 x 5 MHz lots of FDD spectrum and three 5 MHz lots of spectrum for supplementary downlink (SDL). A SMRA (Simultaneous Multiple Round Auction) is to be organized, but the bidder will be allowed to vid only for one block of FDD spectrum and one block of SDL spectrum.

The auction is expected in the first quarter of 2021.

3.4-3.8 GHz / 3.8-4.2 GHz

RRT opened a public consultation on the use of 3.4-3.8 GHz and 3.8-4.2 GHz frequencies from April to May 2018. A second public consultation on the use of 3.4-3.8 GHz frequencies was issued between October and November 2018. The consultation closed in April 2019.

3.4-3.8 GHz frequencies were expected to be awarded by year-end 2020 (depending on talks with Russia on interference issues in border areas). 100 MHz is put aside for PPDR services and communications. The auction is expected in the first quarter 2021. In the meantime, 3.5 GHz band spectrum has been allocated on a temporary and non-commercial basis to Telia Lietuva.

RRT in response to public reactions and the spread of disinformation on 5G, provided clarifications on the technology on its website.

In 2020, the government of Lithuania approved a plan for 5G. Guidelines indicate that at least one 5G network should cover at least one of the national largest cities (Vilnius, Kaunas, Klaipeda, Siauliai, or Panevezys) by 2022 and that at least one 5G network should be available in all 5 cities by 2023. Guidelines also introduced coverage obligations of all urban areas and main transport routes and hubs (motorways, rail routes, airports) by 2025.

Main points

- 5G strategy in September 2018

- 700 MHz and 3.4-3.8 GHz auction expected on 29 June 2020. Rules include coverage obligations and spectrum

- 26 GHz spectrum assignment postponed to 2021

- 5G launch by Post Luxembourg, Orange and Tango in October 2020

Two public consultations have been launched on spectrum for 5G to date followed by the released of the Luxembourg 5G Strategy on September 13th, 2018.

700 MHz/3.4-3.8 GHz

In May 2019, a public consultation was launched on the use of 700 MHz and 3.4-3.6 GHz spectrum for 5G.

The auction of 700 MHz/3.4-3.7 GHz spectrum is expected by June 2020. In December 2019, the Prime Minister said that 50 MHz of spectrum will be added to the 280 MHz initially considered in the 3.5 GHz public consultation. ILR started to hold a consultation on the assignment procedure between 13 March and 10 April 2020. In July 2019, Luxembourg’s Department of Media, Telecommunications and Digital

Policy launched a call for projects involving 5G mobile communications or similar technologies, such as IoT or smart cities. The initiative aims to facilitate the emergence of innovative technologies and services, in line with the country’s National 5G Strategy. Projects should have a duration of between six and 24 months.

Assignment of the 700 MHz (703-733/758-788 MHz) and 3.4-3.7 GHz (3420-3750 MHz) bands is scheduled for 2020 in a SMRA Clock Hybrid single round sealed bid auction. Spectrum from 3.7-3.8 GHz will be considered separately. It is intended to be used by local applications.

Assignment rules were released in March 2020.

- In 700 MHz frequencies, players cannot get more than 2×10 MHz. In 3400-3800 MHz frequencies, players cannot bid for more than 130 MHz. Licenses will be valid 15 +5

- A reserve price has been set at 562 KEUR for 2×1 MHz in 700 MHz frequencies and at 30KEUR for 1 MHz of spectrum in 3400-3800 MHz

- Licenses will include coverage obligations in both bands. In 700 MHz frequencies, players are expected to reach 50% geographical coverage by year-end 2022 and 90% geographical coverage by year-end They will have to light up 10 5G sites by year-end 2020, 20 5G sites by year-end 2021, 40 5G sites by year-end 2022 and 80 5G sites by year-end 2024 in 3400- 3800 MHz frequencies.

| Category | Band | Lot Size | # of lots | Lot rating | Reserve price |

| A1 | 700 MHz

(703-713 MHz paired with 758-768 MHz) |

2×10 MHz | 1 | 4 | € 5,626,000 |

| A2 | 700 MHz

(713-733 MHz paired with 768-788 MHz) |

2×10 MHz | 2 | 4 | € 5,626,000 |

| B | 3600 MHz | 40 MHz | 5 | 4 | € 1,200,000 |

| C | 3600 MHz | 10 MHz | 13 | 1 | € 300,000 |

The 700/3600 MHz auction was completed in July 2020. four out of the five bidders have acquired 5G frequencies in the 700MHz FDD and 3600MHz TDD spectrum auction, paying a total of 41.3 million EUR (Players’ bids are not available). The 15+5 year-licenses include strict geographical coverage obligations for 700 MHz spectrum (50% geographical coverage by year-end 2022 and 90% by year-end 2024). In 3420-3750 MHz frequencies, players have to light up a minimum of 10 sites by ear-end 2020, 20 by year-end 2021, 40 by year-end 2022 and 80 by year-end 2024.

Orange, Post and Proximus were each awarded one of the three available lots of 2×10MHz in the 700MHz band.

In the 3600MHz band, Orange and Post each acquired 110MHz of frequencies, Proximus bought 100MHz and Luxembourg Online 10MHz. Eltrona participated in the auction but failed to secure spectrum rights.

26 GHz

The regulator ILR launched a consultation on the 26 GHz band late in October 2020. The consultation ended on December 8, 2020. The ILR considers alternative mechanisms to assign 26 GHz spectrum.

Main points

- Strategy for 2018-2020 issued in November 2017

- Radio Spectrum Policy Programme 2019-2023 published in July 2019

In February 2017, the Malta Communications Authority (MCA) revised its test and trial-licensing regime to further support the carriage of technology trials such as 5G and IoT. In November 2017, the MCA released an update of its strategy for 2018-2020. Main tasks include:

- Awarding the 800 MHz band and continuing process to clear the 700 MHz

- Publishing and commencing implementation of the National Spectrum Management

- Continuing scoping work on spectrum earmarked for 5G. Managing information as the means to promote competition.

- Continue making the case for assumption of ex-post competition regulation

- Maintaining the compliance framework set at safeguarding a competitiveenvironment

In June 2018, the MCA released the National Roadmap for the UHF band between 470-790 MHz. The 700 MHz band will be made available for commercial wireless mobile broadband services as from June 2021. The roadmap follows a public consultation held between April 23rd and May 22nd, 2018.

In July 2019, the MCA published an amended decision making available the entire 1427-1517 MHz band for terrestrial systems capable of providing electronic communications services in Malta. The decision follows a public consultation procedure undertaken between 27 December 2018 and 8 February 2019.

The MCA published, in July 2019, the latest edition of the National Frequency Plan. The key developments in the Plan include the harmonization of radio spectrum in the 874-876 and 915-921 MHz and the 1427-1517 MHz frequency bands for terrestrial systems capable of providing electronic communications services.

The regulator also published, in the same month, a draft of its five-year Radio Spectrum Policy Programme. The MCA opened a consultation for this paper until the 5th August 2019.

In September 2020, Melita was granted a trial 5G license. The trial started in September 2020 at the Melita Data Center and at locations in Sliema, Saint Julians and Valetta.

Main points

- Connectivity Action Plan, July 2018.

- In December 2018, the Netherlands Authority for Consumers and Markets (ACM) published a 5G paper “5G and the Netherlands Authority for Consumers and Markets”.

- Multi-band 700/1500/2100MHz completed in July 2020 raised 1.23 billion EUR

- 3400-3450 and 3750-3800 MHz intended for local use scheduled respectively for 2022 and 2026

- 5G launch by VodafoneZiggo in April 2020, by T-Mobile and KPN in July 2020

In June 2019, the ACM released an updated spectrum plan for 5G. The telecom regulator intends to auction 700, 1500, 2100 and 3500 MHz. The 3500 MHz (3400-3450 MHz) is scheduled as from September 2022 and 3750-3800 MHz frequencies from 2026. The 3500 MHz auction is planned for 2022 as the band is currently used for satellite communications. Spectrum at 3400-3450 MHz and 3750-3800 MHz is intended to be made available for local use.

700/1500/2100 MHz

In December 2019, a public consultation was opened potential spectrum caps for 700/1500/2100 MHz spectrum and a reserve price that would raise at least 0.9 billion EUR. Licenses will include coverage obligations of 98% geographic coverage of all domestic municipalities. The auction itself is scheduled for June 2020. Applications are due before 6 April 2020.

The multi-band auction started on 29 June 2020. It raised 1.23 billion EUR. Each operator won 2×10MHz in the 700MHz band and 2×20MHz in the 2100MHz band. In the 1400MHz band, KPN and VodafoneZiggo bought 1×15MHz each and T-Mobile acquired 1×10MHz. Spectrum in the 700MHz and 1400MHz will become available immediately, the 2100MHz licences will be available from early 2021. Licences include coverage obligations of 98% geographic coverage of all domestic municipalities. Licenses which will be issued in summer 2020 will run until 2040. The auction was cleared by the Court of The Hague one day before the announcement by the regulator. A lawsuit had been launched by Stop5GNL to block 5G auctions and rollout blaming negative health effects.

3.6 GHz

The 3.6 GHz auction is planned for 2022 as the band is currently used for satellite communications. Spectrum at 3400-3450 MHz and 3750-3800 MHz is intended to be made available for local use.

26 GHz

The use of the 26 GHz band is under consultation use of spectrum either for shared use or local authorizations from 2020. The consultation closed at the end of February 2020.

Main points

- 5G Strategy for Poland, January 2018.

- 5G spectrum consultation, July 2018.

- A few trials to date.

- 3.4-3.8 GHz auction stopped in March 2020 due to covid-19, expected before year-end 2020. Licenses will be issued in 2020.

- 700 MHz auction expected by 27 August 2021

- 5G services launched by Polkomtel with 2.6 GHz spectrum in May 2020, by T-Mobile Poland early June 2020 in 2100 MHz spectrum, by Orange in July 2020 on 2100 MHz

700 MHz

In January 2018, the Ministry of Digital Affairs opened a public consultation on the “5G strategy for

Poland” until 11 February 2018.

According to the document, Poland will launch 5G in 2020 with 700 MHz frequencies in at least one Polish city by year-end and transport paths will be covered by 2025. Frequencies in the 3.4-3.8 GHz and 26 GHz bands will be assigned in 2021. The 5G strategy for Poland steered by the Ministry of Digital Affairs will be funded by public and community funds until 2023. The Ministry of Digital Affairs will allocated PLN 10-15 million to digitalization until 2023. The Ministry aims at easing permission for installing parts of the networks (e.g. masts) and restrictions on electromagnetic emissions.

Between July and August 2018, The Polish Office of Electronic Communications (UKE) issued a consultation on frequencies for 5G covering 700 MHz, 3.4-3.6 GHz, 3.6-3.8 GHz and 26 GHz bands. It proposes the sale of spectrum in these bands. Parts of the bands are currently used for telecom and TV services. UKE considers reorganization and reallocation in all bands.

In December 2018, UKE asked if 700 MHz spectrum could be opened up from 2020 to 2022. In November 2020, UKE announced the auction should be completed by 27 August 2020.

3.6-3.8 GHz

In April 2019, the UKE announced that 3.6-3.8 GHz spectrum could be awarded by June or July 2020. The income of the Polish state budget from the auction is expected to amount to PLN 3.5-5 billion.

The UKE decided, in late August 2019, to allocate 5G-capable spectrum in the 3.4GHz-3.8 GHz range via a competitive auction rather than a tender process.

In December 2019, UKE opened a consultation into its planned auction of four licenses in the 3.4-3.8 GHz band. The NRA indicated it wants to award the four licenses by mid-2020. The licenses will be valid until the end of June 2035. The proposed starting price for each block is PLN 450 million (103.4 million EUR). The process kicked off in March 2020. Four lots of 80 MHz will be auctioned: concessions A (3480MHz-3560MHz) and B (3560MHz-3640MHz) will offer full nationwide coverage, licenses C (3640MHz-3720MHz) and D (3720MHz-3800MHz) will have geographic restrictions:

- at least 10 base stations in the area of 1 voivodship city selected from the cities indicated within 4 months of receiving the licence;

- until 31 December 2023, at least 300 base stations throughout the country, including at least 10 base stations in the area of each of at least 20 municipalities selected from the indicated municipalities, with the proviso that at least 9 voivodship cities will be selected;

- until 31 December 2025, at least 700 base stations throughout the country, including at least 10 base stations in the area of each of at least 30 municipalities selected from the indicated municipalities, provided that at least 16 voivodship cities are selected.

The commitments were designed in a way to ensure network roll-out in the largest population centers, i.e. municipalities with more than 80,000 residents.

The auction was postponed from March to year-end 2020 due to covid-19. It is likely to take place in the first quarter 2021.

26 GHz

The auction is expected before 2022.

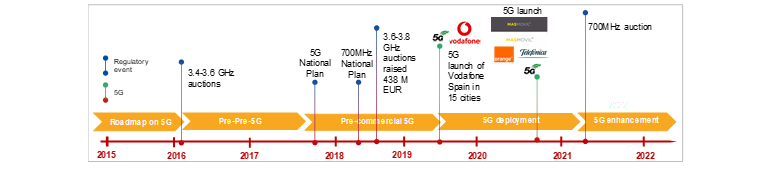

Main points

- Multi-band auction (700/900/1800/2100/2600/3600 MHz) postponed in March 2020 due to covid and rescheduled for October 2020, and further rescheduled to early 2021

- 26 GHz auction expected in 2023

Public consultation on spectrum for 5G was released between March and April 2018. Frequencies studied included 450/700/900/1500/1800/2100/2600/3600 MHz and 26 GHz frequencies.

In July 2018, the Portuguese regulatory authority ANACOM approved the 700 MHz band plan for 5G services. The 700 MHz band will be freed up by June 2020. The release of the band will start in Q4 2019.

At the end of 2018, Portugal indicated that it was establishing a working group to work on the development of the Portuguese national 5G action plan. On the first half 2019, it worked on a public consultation on a proposed multiband spectrum auction (450/700/900/1500/1800 MHz, 2.1/2.6/3.6/26 GHz).

In October 2019, telecommunications market regulator Anacom announced plans to hold an auction for six frequency bands including the 700 MHz band and 300 MHz of the 3.6 GHz band, between April and June 2020. Commercial usage is expected during 2020.

Early 2020, ANACOM launched a consultation on the upcoming multi-band auction including coverage and speed obligations of 100 Mbps for 85% of the population in 2023 and 95% in 2025. ANACOM also approved the draft rules for the auction with reserve prices as follows:

- 700MHz; six lots of 2×5MHz (19 million EUR per lot)

- 900MHz; one lot of 2×5MHz (30 million EUR per lot)

- 900MHz; four lots of 2×1MHz (6 million EUR per lot)

- 1800MHz; three lots of 2×5MHz (4 million EUR per lot)

- 2100MHz; one lot of 2×5MHz (2 million EUR per lot)

- 2600MHz; two lots of 2×5MHz (3 million EUR per lot)

- 2600MHz; one lot of 25MHz (3 million EUR per lot)

- 6GHz (with restrictions until 2025); six lots of 10MHz (840,000 EUR per lot)

The multi-band auction initially scheduled for sometimes between April and June 2020 was postponed due to the Covid.. Auction rules were published in November 2020. New entrants are encouraged to participate: a bloc of 900/1800 MHz spectrum has been set aside for them. In addition, providing them nationwide roaming is mandatory. Nos, Vodafone, MEO, Novo (Grupo Masmovil) and DenseAir Portugal submitted applications before the 26 November 2020 deadline. The licences would be distributed early 2021.

Early 2020, Anacom modified spectrum held till August 2025 by DenseAir in the 3.4-3.8 GHz spectrum. The amount of spectrum held will be reduced from 168 MHz to 100 MHz and relocated in the lower part of the band.

Main points

- National Strategy for the Implementation of 5G in Romania

- Multi-band 5G auction rescheduled for the second quarter 2021

- 5G launch by RC&RDS and Vodafone in June 2019, by Orange in November 2019

The National Authority for Management and Regulation in Communications (ANCOM) launched a public consultation on 5G spectrum between May and June 2018.