700 MHz/1500 MHz/2100 MHz

In September 2020, the Austrian regulator RTR finally completed the delayed multi-band 5G auction. RTR had to postpone the auction due to the Covid-19 outbreak. The second 5G auction in Austria awarded frequencies in the 700 MHz, 1,500 MHz and 2,100 MHz bands, raising 202 million EUR. In March 2019, 3.4- 3.8GHz spectrum was auctioned to seven successful bidders generating 188 million EUR.

27 blocks were up for sale, including six blocks in the 700MHz band, twelve in the 2100MHz range and nine in the 1500MHz band.

T-Mobile Austria paid 87 million EUR for 2×20MHz of 700MHz spectrum, 20MHz in the 1500MHz band and 2×15MHz of 2100MHz spectrum. A1 Telekom will pay 66 million EUR for 30MHz of frequencies in the 1500MHz band and 2×25MHz in the 2100MHz range. The incumbent player did not get 700 MHz spectrum. Hutchison Drei won 2×10MHz of 700MHz spectrum, 30MHz in the 1500MHz band and 2×20MHz of 2100MHz frequencies for a total of 50 million EUR.

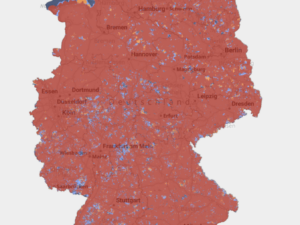

The government aims to deploy 5G on main traffic routes by the end of 2023 and to reach “virtually nationwide” 5G coverage by the end of 2025. 700 MHz licences will include coverage of 80% of 2,100 underserved communities with download speeds of 30 Mbps and 3 Mbps for upload by 2027, and 90% of federal and state roads should get at least 10 Mbps for downloads and 1 Mbps for uploads.

3.4-3.8 GHz

In February 2018, RTR held a third consultation (after a second mid-2017 on the auction design) on the award procedure for the frequency band 3.4–3.8 GHz, comprising 190 MHz within the 3410 MHz-3600 MHz range and 200 MHz in the 3600 MHz-3800 MHz band (designated for 5G broadband services). Spectrum caps per operator, coverage requirements and minimum bids are mentioned (spectrum cap of 140 MHz to 160 MHz per operator, provision of up to 1,000 locations with 5G, 50% coverage by mid-2020, 100% by year-end 2021, depending on the frequency and the region considered, minimum bids of around 30 MEUR).

5G spectrum auctions (Simple Clock Auctions or SCA, regional basis) took place in March 2019. Licenses will be valid 20 years, running thus until year-end 2039. The Government obtained 188 MEUR from these auctions.

26 GHz

The 26 GHz band was not mentioned in the 2016 Spectrum release Plan.

In June 2019, RTR issued a public consultation on 2.3 and 26 GHz bands (24.25-27.5 GHz).

: earmarked,

: earmarked,

: allocation procedure scheduled,

: allocation procedure scheduled,