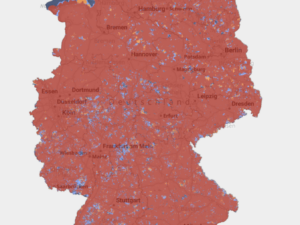

Investments in fibre and LTE networks’ upgrades is key for 5G successful deployment. Aside from acquiring wireless spectrum, MNOs are investing in upgrading existing LTE and fixed networks. Major issue of interests include deploying small cells, 4×4 MIMO, CA…. 5G deployment in Europe will start in urban areas and will later expand to urban areas and major roads.

MNOs investments & Equipment vendor contracts

As 5G preparation is heating up, MNOs start to announce investments they commit to make.