To fulfil its potential 5G needs access to much higher frequencies: 3.5 GHz and above. This was not the case with earlier mobile generations.

5G can offer higher speeds because the higher frequencies have more bandwidth than the lower ones traditionally used for mobile. This is particularly true of the mmWave bands: 26 GHz has 2.25 GHz available, compared to 45 MHz in the 700 MHz band.

Spectrum release timeline

Internationally there has been a race to ensure that spectrum is made available for 5G. The USA auctioned mmWave spectrum in 2019 and in the same year the EU harmonised three 5G “pioneer bands”: 700 MHz, 3.6 GHz (3.4-3.8 GHz) and 26 GHz (24.25-27.5 GHz). By the end of 2020, most EU countries had made these bands available.

There is a consensus that 5G needs low bands for coverage, medium bands for faster speeds covering a reasonable area and high-frequency bands for the highest speeds. Currently, the most used bands are:

- Low-band: 700 MHz (except in US); 600 MHz (US)

- Mid-band: 3.3 – 3.8 GHz (except US); 2.6 GHz, 3.7 – 4.98 GHz (US)

- High-band: 26 GHz (except Japan, South Korea and US); 28 GHz (Japan, South Korea and US)

At the ITU World Radio Conference in 2023 (WRC-23) a further IMT identification could be approved for 3.3-3.4 GHz, 3.6-3.8 GHz, 6425-7125 GHz and 10.1-10.5 GHz, facilitating the use of these bands for 5G.

Which bands are most used?

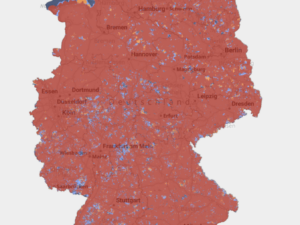

At the end of March 2021, 5G commercial services had been deployed in 24 EU-27 countries. The most used frequency bands are 700 MHz and 3.3 – 3.8 GHz with the latter established as the global workhorse band for 5G.

The slightly higher 3.7-4.2 GHz was viewed until recently as more peripheral. Some European countries had offered it directly to industry verticals. Japan had awarded 3.6-4.0 GHz to mobile operators for 5G in 2019 but that was a relatively rare occurrence.

Those assumptions were smashed by the staggering prices that US mobile operators paid for the 3.7 – 3.98 GHz band at an auction that concluded in early 2021. In total, operators paid $81 billion for the spectrum, plus $9.7 billion in incentive payments for incumbent satellite operators to vacate the band. It is fair to expect more activity in 3.7-4.2 MHz band.

mmWave frequencies have not seen wide commercial deployment, and most EU countries have yet to auction off the 26 GHz or 28 GHz band. The US led the world in making the 28 GHz band available for 5G. Several other countries, particularly Japan and South Korea, quickly followed. However, in the last couple of years interest in either 26 GHz or 28 GHz has waned.