Product/market developments

1. Overview of the 5G baseband market as of March 2021:

Now 4 generations of (high-end) 5G chipset and the market is expanding

In 2019 and 2020, the 5G chipset market has seen several announcements that point to both an increased maturity and competition on the market and in February 2021, when Qualcomm announced the 4th generation of its flagship 5G baseband, the previous generation was only starting to be available in commercial end-user devices.

In the meantime several mid-end 5G chipsets have been announced, not only by Qualcomm but also its competitors and the end of the year has even seen the release of even lower-end chipsets such as the Mediatek Dimensity 720 that is powering the cheapest 5G phone, the Oppo Realme v3, at 146 USD (in China) or the Snapdragon 480 (announced at the beginning of 2021).

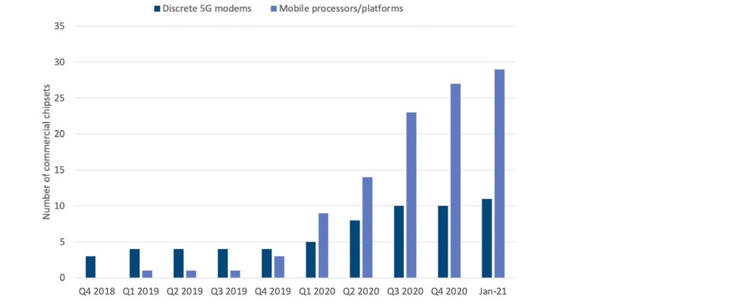

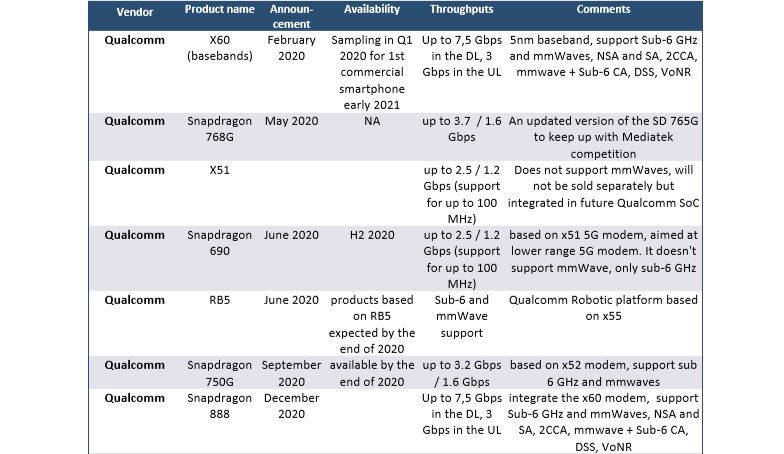

While first integrated 5G SoC announced can be dated back to September 2019 with the Samsung Exynos 980, followed by Huawei/HiSilicon Kirin 990 5G, all targeting the high-end market, the end of 2019 and the course of 2020 has seen several other 5G SoC announced and launched by Qualcomm (SD765/765G with its updated version the SD 768), Huawei (Kirin 820 and 985 5G), Samsung (Exynos 880) and Mediatek (Dimensity 1000L and 1000+ as well as the lower end Dimensity 820; 720, 700). This is not anecdotal as the gist of the new chipsets announcement is now System on Chips integrating one baseband with capabilities adapted to the price tear of the targeted device. This can be seen in the figure below that shows there are now more 5G SoC than discrete 5G baseband on the market and that this trend has only expanded since our last update in March 2021.

Evolution in the number of commercial 5G chipset

Source gsacom

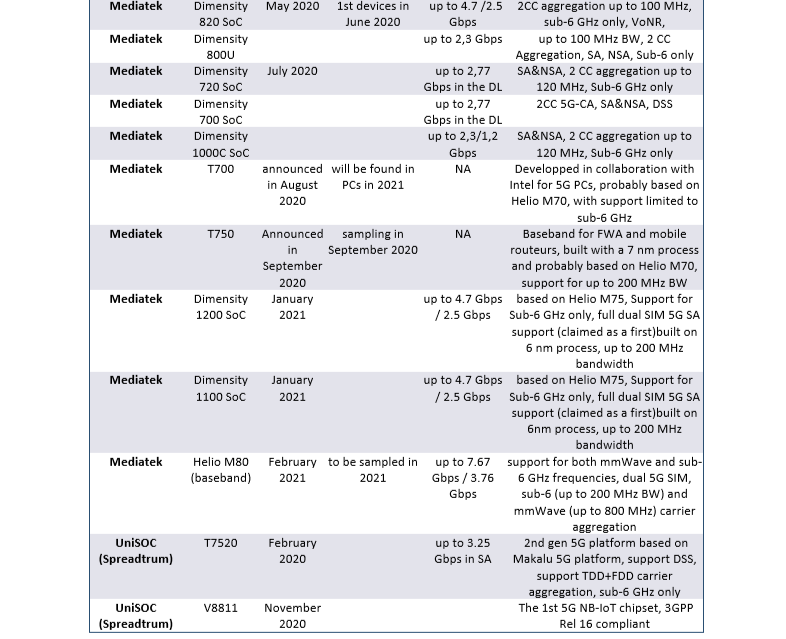

While those new lower tier chipsets have initially had in common the fact that they only supported the sub-6 GHz frequency range, this has started to change with the introduction of Qualcomm Snapdragon 480 a further indication of the ever evolving market. Indeed, limiting 5G chipset to sub 6 GHz is a way to reduce the Bill of Material (BOM) and make it more adapted to both lower tier segments and markets where mmWave is not yet available. However, as mmWave is slowly being introduced in more markets than just in the US (South Korea, Japan, Russia, Italy, Singapore…) limited support for mmWave in lower end 5G chipset now can be seen, the SD480 is the first to feature this capability. Announced on the 4th of January 2021, the SD480 support both sub 6 GHz frequency bands and mmWave, albeit with some limitations:

- Bandwidth limited to 200 MHz in the mmWave for 2.5 Gbps maximum 5G throughput

- No cross carrier aggregation between mmWave and Sub 6 GHz spectrum

As of the end of February 2021, around 45 5G chipsets had been in development or released but at the same time, only 35chipsets could be considered as commercially available (9 from Qualcomm, 6 from Huawei, 6 from Samsung, 12 from Mediatek, and 2 from UniSoc). As of the end of September 2019, we reported only 5 of them and only 8 at the end of December 2019.

It is to be noted here that in this count of 5G chipset. Discrete 5G modem that are not sold separately, such as the X52 or x51 Qualcomm modem are not included, even though, as such they could be considered as modems.

Presentation of announced 5G chipsets

Source: IDATE DigiWorld, March 2021

What differentiates those chipsets?

The number of features sometimes makes it difficult to differentiate all those chipsets and indeed a lot is shared on the paper. We used to mention the support for SA in addition to NSA as a differentiator, but all 5G baseband now support both modes, although probably the support for more specific implementation of SA and NSA mode could be discriminated. Below are the features where 5G chipset might differentiate:

- The number of carriers that can be aggregated both in the sub-6 GHz and in the mmWave bands: while early 5G basebands were capable of aggregating up to 100 MHz in the sub-6 GHz at the beginning and up to 800 MHz in the mmWave (even though no operator currently hold such among of spectrum), the increased technology and market maturity have enabled players to largely differentiate with the maximum amount of bandwidth possible for each part of the spectrum. Recently announced x65 discrete modem from Qualcomm (February 2021) will for instance support the aggregation of up to 1000 MHz of spectrum in the mmWave bands and up to 300 MHz in the sub-6 GHz, something naturally associated with higher peak download speed. In the lower price tier, different combination of maximum bandwidth is used to segment the market even further

- Capability to aggregate sub-6 GHz and mmWave spectrum for increased maximum throughput up to 10 Gbps (Qualcomm x65). This is especially important for increased coverage and will ease the transition for operator from NSA to SA.

- Support for mmWave bands: Because the deployment in those frequency bands has so far been limited outside Verizon, the absence of support for mmWave has not been an issue and an opportunity to develop lower end / cheaper 5G chipset, while still providing an enhanced user experience over 4G. MmWave bands however have started to be deployed outside the US in the 2nd half of 2020 and should continue their ramp-up in Europe and in other parts of the world in 2021.

- Support for DSS (Dynamic Spectrum Sharing) feature, which enables the dynamic deployment of 5G in 4G bands, as standardized within 3GPP (instead of dedicating fixed portion of spectrum to RAT as was usually done with refarming. While absent from early generations of 5G chipset, DSS is now commonly supported by every player on the market.

Those capabilities differentiate chipset between each other and often between the different generations of 5G chipsets.

State of the competition

The 5G baseband market is quite different from the 4G and earlier generation baseband market. Actually, each new generation of cellular technologies has seen a player leaving the market and a new one emerges. As an example, TI left the baseband market with 3G and Infineon sold its cellular asset to Intel. In 4G, several players left the baseband market, such as Broadcom, despite several acquisition or Fujitsu. With 5G, Intel was the first to leave the (device) baseband market by selling its cellular assets to Apple. Due to the economic war between the US and China, the future of Huawei chipsets, with the inability to rely on TSMC foundry 5nm process starting on 15th of September 2020 is also uncertain. Since our last update, Huawei is the only player for which we were not able to find a new 5G chip in its portfolio. The latest flagship device from Huawei uses the Kirin 9000 chipset, which is reportedly based on the Balong 5000 modem that was announced in 2019.

In 5G Qualcomm is still considered the leader in market share but recently, the rise of Mediatek with its Dimensity range of 5G modem, now commercially available is somehow changing the competitive landscape and this is particularly true in China where tensions with the US put Huawei in a difficult situation regarding its chip design capabilities. While Counterpoint Research estimates Qualcomm market 5G smartphone market share to be around 39% of the sold in Q3 2020, Mediatek has been growing dynamically throughout 2020. In Q3 it even surpassed Qualcomm on the global smartphone chipsets market, benefiting from the growth in China and India and the next step for Mediatek would be to surpass Qualcomm in volume for the whole 2021 year, something that Mediatek might very well accomplish if we look at the ever increasing number of 5G chipsets announced.. With the announcement, of its x65 latest generation of 5G baseband, Qualcomm however is demonstrating it is still a little bit ahead in terms of technology development. X65 5G modem will support up to 10 Gbps throughputs.

Samsung and Huawei

While Samsung and Huawei, number one and three in the smartphone market in 2020 have initially used their chipset internally, this situation has changed throughout the time, as both chipset manufacturers have been mentioned as selling their chipset to other device manufacturers, mostly Asian one. As mention earlier, the situation of Huawei is uncertain because of the political rivalries between the US and China. In a not-so-distant future, they will both be joined by Apple, after the Cupertino company acquired Intel cellular assets for mobile devices. For now, Qualcomm is still benefiting from this situation, since Apple is not currently capable of using its own silicon for 5G connectivity and has inked a licensing deal with Qualcomm to use their 5G products. The new iPhone 12, which is powered by Qualcomm x55 5G modem has positively impacted the latest financial results from Qualcomm in the last quarter.

Mediatek is now challenging Qualcomm in 5G

After a slow 5G headstart, Mediatek has turned into a serious competitor in the recent months thanks to the growth in the very large Chinese market as well as thanks to the difficulties leading Huawei to partly rely on Mediatek 5G chipset in lieu of HiSilicon chipsets difficult to be produced in the context of US restriction on doing business with Huawei. In recent months, Mediatek has been mainly competing on the mid-end and low-end 5G chipset market, launching a host of different SoC. For various price ranges. The Dimensity 720 announced in July 2020 for instance power the cheapest 5G smartphone to date, the Oppo Realme v3 which can be found at around 120 EUR in China. Mediatek’s portfolio of 5G chipsets is rich with several different SoC based on the same 5G baseband. In August and Sept 2020 it also announced specific 5G chipsets for PCs built in partnership with Intel and 5G chipsets for the FWA market. In February 2021, Mediatek announced its 2nd generation of 5G baseband, the M80, which is likely to be integrated into the new SoC to be announced in 2021. M80 5G baseband marks the 1st 5G baseband from Mediatek to support mmWaves with maximum reachable throughput of 7.67 Gbps with a capacity to aggregated up to 800 MHz of spectrum in the mmWave. This set this baseband in the same ballpark as Qualcomm x60 announced one year ago. Mediatek M80 is to be sampled during 2021.

As for Unisoc which announced the Makalu Ivy510 at MWC 2019, it is targeting the (Chinese notably) mid-tier smartphone and IoT market. Unisoc was previously known as Spreadtrum and had a development partnership with Intel for LTE chipset for Chinese devices but the partnership over 5G has been dropped and Unisoc is now following its own route. In February 2020, it announced its 2nd generation 5G chipset, the T7520 SoC, which Unisoc claims as “the all-around leader in power consumption for both light-load and heavy-load scenarios and delivers a power consumption reduction of up to 35% for some data business scenarios.”, a claim, which of course remains to be verified. Unisoc power smartphones commercially available from HiSense, CoolPad, and AGM notably, smartphones that are targeting the Chinese market. Interestingly, Unisoc announced in November 2020, what it claims as to the 1st 5G NB-IoT 3GPP Rel 16 compliant chipset.

Apple to develop its own 5G modem for tighter control and integration

After Intel quitted the smartphone chipset market in April 2019, Apple purchased most of Intel 5G business for 1 billion USD with the intent to develop its own 5G baseband. In the meantime, Apple is using Qualcomm 5G modem after it reached a 6-year licence agreement as a settlement for the litigation between Apple and Qualcomm. The reason for Apple to develop its own modem is above all the capability to better integrate connectivity capabilities to Apple global ecosystem of devices, not only in iPhones and iPad, for which a homegrown ARM-based processor has already been available for many years but also for the rest of its line of computers. In mid-June 2020, Apple indeed announced its choice to transition from Intel x86 architecture to the ARM architecture, something which resulted in the commercial launch of the first ARM-based Mac computers in November 2020. By mastering and fully controlling the processors of Mac computers, Apple will be able to develop and integrate new features, of which of course 5G connectivity.

It is estimated that Apple own 5G modems could come to the market around 2023-2025. Such modems are very unlikely to be sold to other OEMs as they are meant to become a differentiating point for Apple. While designing a cellular modem is no easy task, Apple has proven in the past that it could acquire knowledge and competencies in the design of new solutions, something that takes time to reach maturity but will in the end serve the interest of Apple.

In October 2020, Apple launched its line of 5G iPhones, using Qualcomm x55 modem and the next iPhone in 2021 is likely to be powered by Qualcomm x60 generation. Being at the forefront of the cellular connectivity field has never been a focus for Apple, which has always had a conservative approach in that domain (remember, iPhone 1st generation was a 2.5G smartphone).

2. 5G devices announced at the end of 2020

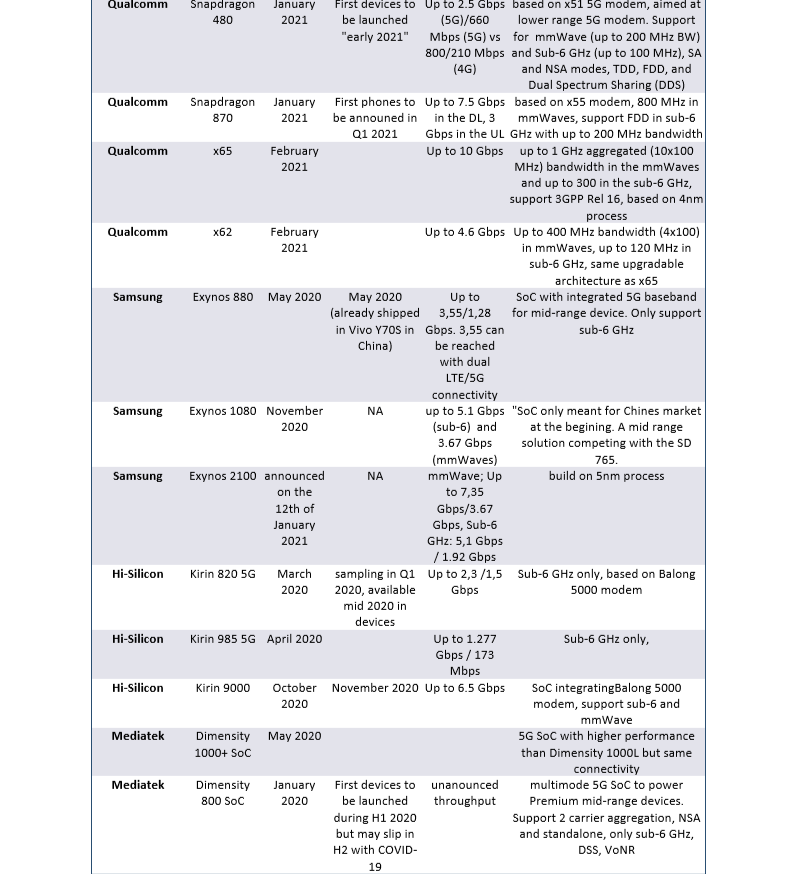

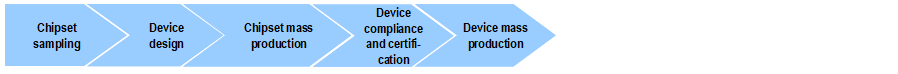

The release of 5G baseband and RF systems is the first step before commercial devices. Usually, when a new radio technology is released, basebands are developed and implemented in relatively simple devices such as mobile WiFi hotspots, before more complex devices such as smartphones, where integration is always more challenging. Before fully commercial devices can be made available, several steps are required.

The steps a device takes to market

Source: IDATE DigiWorld, September 2018

This time, with 5G, Fixed Wireless Access was one of the first use cases, rather than mobile usage and first commercial devices announced have been 5G home routers, such as the one announced by Huawei at MWC 2018 in Barcelona, or the one by Samsung. Those early devices have been more specifically designed for carrier partners Verizon in the US and in South Korea, and have already received their approval from the FCC. Since then, many other routers and CPEs have been released for various usage and with newer 5G chipsets and capabilities.

Example of routers based on Snapdragon 865 (based on 2nd gen x55 5G modem)

Source: Qualcomm

Source: Qualcomm

Since then, however, the ecosystem has continued its expansion alongside that of the smartphone devices. An illustration of this is the announcement in October 2019 by Qualcomm that over 34 OEMs had planned to use its X55 5G modem alongside a specifically designed for FWA antenna solution.

OEMs planning to launch Qualcomm based x55 5G FWA CPEs

Source: Qualcomm

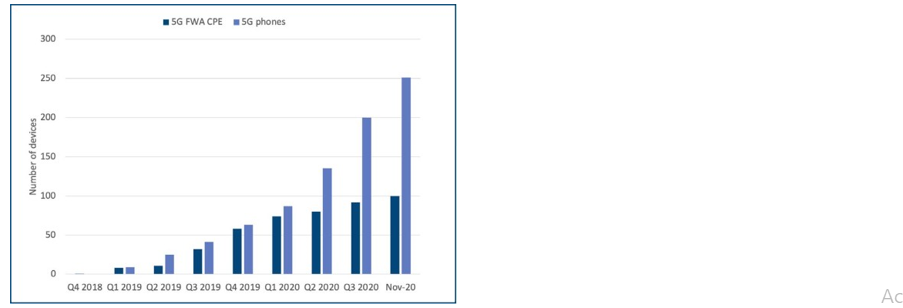

As an indication of the traction of 5G FWA CPE devices on the market, the evolution of the number of 5G FWA CPE devices is available below. Between Q3 2019 and Q4 2019, the number of such devices listed more than doubled and it took nearly one more year after that, between December 2019 and November 2020 for this number to double again. As of the end of January 2021, 144 5G CPEs were listed. According to Gsacom, as of the end of September 2020, 37 operators had launched 5G FWA services in the world versus 33 in May 2020.

Growth of the number of 5G FWA CPE devices announced (as compared to 5G phones)

Source: gsacom

Smartphones and modules, the most popular form factors indicate an already relatively rich ecosystem powered by 5g basebands

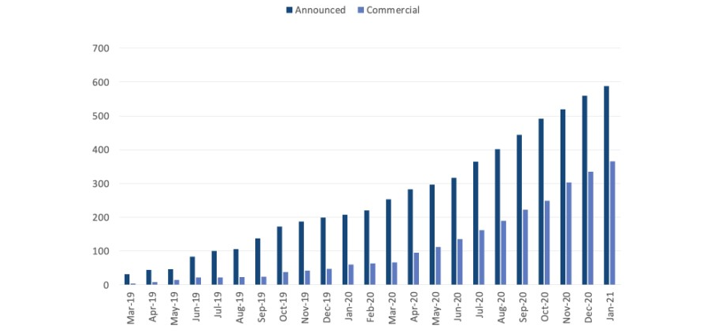

But since those early 5G devices designed for fixed wireless usage, the first mobile 5G networks have been launched in the world and the device ecosystem, thanks to the enabling basebands, has “considerably” widened. As of the end of January 2021, indeed, Gsacom reported 588 5G devices announced by 113 different vendors and 20 different categories of form factors, some of which are fairly similar. As a comparison, in December 2019, Gsacom reported around 15,000 different LTE devices. Of those 588 5G devices, at least, 365 are commercially available, which is a more than 3.5 multiplication as compared to May 2020 and a 46.6% increase in the last three months. It certainly indicates a continued momentum in the building of the ecosystem.

Growth of announced 5G devices (not all commercially available) as of end of January 2021

Source: Gsacom

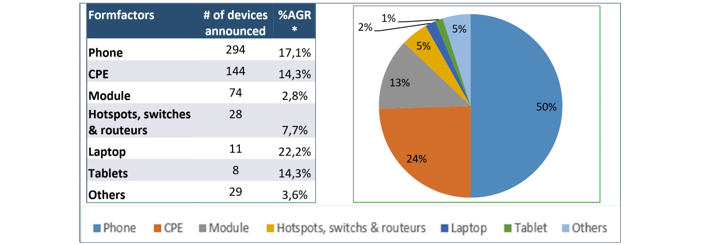

Simplified distribution of the 5G device ecosystem as of January 2021

Source: Gsacom, as of the end of January 2021

The fact that smartphones are the 1st category of devices announced together with modules is a noteworthy fact. CPEs and modules, are usually the first devices to go to the market when a device ecosystem is building up but smartphones usually come afterwards. Between December 2019 and the end of November the number of 5G smartphones has nearly quadrupled. Smartphones are not only the 1st category of device in the 5G ecosystem but also the fastest growing one and a category set to continue its growth as 5G attracts more and more users.

In detail, most of the devices launched in 2020 have been based on second-generation 5G baseband and it is only one year after its announcement that 3rd generation 5G modem are going to take place in commercial devices, just as new generations of basebands are being announced.

While initial 5G devices often had either sub 6 GHz, either mmWave RF system, 2020 has seen first mmWave+sub6 GHz devices. The reason for not including support for both frequencies was to be found in the different geographical/market choices regarding frequency bands for deployment, but also in the cost that those additional frequency bands incur. At this stage, the RF and antennas add a significant toll to the total Bill of Material (BOM) of 5G devices without even talking of power consumption, time has not yet come for worldwide 5G devices supporting all the 5G frequency bands. One important aspect though is that 5G devices that have been released in 2020 now support sub 6 GHz FDD and not just TDD. While TDD mode is important for mid and high-frequency bands, FDD is key for lower frequency bands (those frequency bands used for 2G, 3G and 5G). While those bands sport more limited throughput, they are key for 5G roaming, as operator will be vying for expanded coverage and SA deployments.

In 2020, as lower-tier 5G solutions have been released on the market thanks to a wider 5G baseband/SoC portfolio, the premium price for 5G device has continued to decrease. This decrease of the price initially comes principally from cost optimizations and “reduced” 5G performance as compared to high-end 5G solutions as exemplified by the difference between the Snapdragon 765 and the x55 modem that is found in the snapdragon 865. The 5G performance of the Snapdragon 765 is still far better than the best 4G possible performance, topping at a theoretical downlink throughput of 3.2 Gbps but is still below the 7.5 Gbps that the x55 is capable of. Likewise, the newly released Snapdragon 480, while supporting both sub 6 GHz and mmWave only supports bandwidth up to 200 MHz, in the end “only” providing up to 2.5 Gbps downlink throughput in 5G (vs 660 Mbps in LTE). Of course, this differentiation doesn’t really matter when the capabilities of the network do not even match this level of throughput.

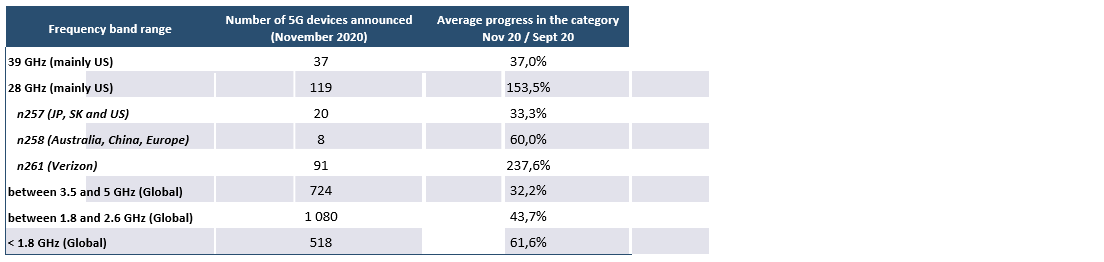

The 3.5 GHz frequency band, still the most popular frequency bands for 5G

Despite much noise around mmWave bands deployment abroad, the sub-6 GHz device ecosystem is doing strong and especially the 3.5 GHz band which provides interesting capabilities with a mix of coverage and capacity when wide bandwidth configuration are used (100 MHz). More precisely, the n78 band (3.5 GHz) is the most popular frequency band in terms of devices announced mirroring the sizeable number of networks believed to use this frequency band. As of the end of November 2020, 57% of devices announced or in development supported this frequency band vs 30% for all mmWave bands. Given the wide availability of this frequency band worldwide, this is not a big surprise. While not providing as much bandwidth as mmWave bands (largest possible bandwidth configuration is 100 MHz) it is providing a much larger coverage. As compared to lower frequency bands, it still sports better capacity and is better suited to massive MIMO deployment in the field because of the much smaller antennas required.

Thanks to features such as Dynamic Spectrum Sharing (DSS), a 5G device ecosystem for “legacy frequencies” is also being built with devices announced supporting several of those bands (such as the much-used 1800 MHz, 2100 MHz, or 700 (APT) MHz) especially as operators in the US (AT&T and Verizon but also T-Mobile without DSS) have started to deploy in those low bands in 2020. During the last three quarters, the number of devices supporting those frequency bands has grown substantially indicating a clear interest from operators in those frequencies as they prepare to leverage their existing asset in complement to mid-frequency band. In 2021, the support for sub-6 GHz carrier aggregation should further drive the support for those bands including in Europe where DSS has also been deployed in the field with various strategies depending on the operators. In France for instance, Free Mobile (Iliad) has heavily relied on DSS on the 700 MHz (3GPP B28) to provide wide 5G coverage at the launch of 5G in the country in addition to a much less important number of 3.5 GHz sites, whereas competitors have focused initially on 3.5 GHz frequency band experience. Of course, the use of such low-frequency bands for 5G comes with inferior throughput but from a marketing standpoint, it enables operators to claim a coverage dominance over the competition.

Not surprisingly again, much of the mmWave device ecosystem is driven by the need to support US 5G networks but this has started to change in 2020 as other mmWave deployments have taken place during the second half of this year in countries such as Korea and Japan but also in Russia, Singapore and Italy where usage for FWA has started. While no devices had been announced for n258 (26 GHz) band in December 2019, (the mmWave frequency of choice in Europe (and China) for latter deployments), this band has humbly jumped from 0 to 3 devices in March 2020 to 5 at the end of May 2020, and now 8 by the end of November which for now still remains anecdotal. In 2021, the ecosystem for mmWave devices should continue to build up as more countries, including in Europe will start to deploy some mmWave networks. In the last two months, the growth dynamic for mmWave devices has come from the n261 bands used by Verizon Wireless.

Distribution of announced 5G devices by range of frequency band

Source: gsacom, halberdbastion and IDATE * Note that one same device might be listed several times in different category when supporting several bands at the same time

A 5G smartphone supported on average 8.3 different 5G NR frequency bands in 2020

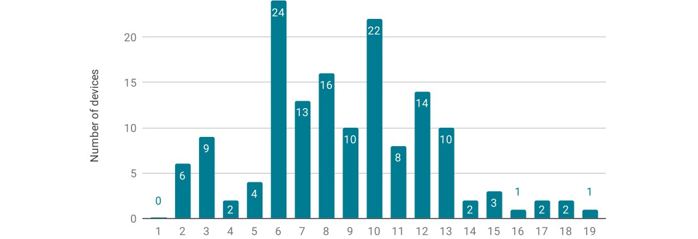

Starting with LTE the number of frequency bands in has increased significantly to support increased throughput thanks to carrier aggregation and availability of wider bandwidth in higher spectrum. This however has led to more RF complexity in our devices with the need to support an even bigger number of frequency bands in the same devices to cater to the situation of each market and reduce the variant of the same device for different markets. As an example, an iPhone 12 (model A2403) supports 30 different LTE and 5G NR frequency bands. This is an extreme example and such number of bands support is usually limited to higher-end devices that can support such an increase in the Bill of Material. A report from the GCF, the certification stated that in 2020, certified 5G devices on average supported 8.3 different 5G NR bands, with the following repartition:

Multiband deployment of 5G NR

Source: GCF

What comes out from this figure is the fact that 78% of 5G devices certified in 2020 had between six and thirteen different frequency bands.

The building up of a 5G device ecosystem

As 5G Standalone deployments have started in a few countries such as in China and in the US, the existence of devices supporting this mode is of paramount importance. According to Gsacom, at least seven operators in five countries/territories are understood to have launched public 5G SA and 68 operators in 38 countries worldwide have been more generally investing in public 5G SA networks.

While nearly all baseband now supports SA modes, it was not the case at the beginning of the building up of the ecosystem. As of February 2021, Gsacom however reported 304 announced 5G devices with support for 5G standalone of which 204 were commercially available. This accounts for 47% of the total number of reported 5G devices. As an indication, this amounted to only 28% in March 2019. This share could increase easily as network operators decide to start the deployment of native 5G Core required for SA deployment as a software update is possible to turn this capability on for devices with compatible basebands. 5G SA is key for the support of new features such as network slicing and all other use case envisioned for 5G such as massive Machine Type Communication or URLLC. It should be especially important for private 5G networks to be built in the future in the same way support for bands such as n77 (3.7 GHz) and n79 (4.5 GHz for use in China and Japan) or n48 (CBRS in the US) will pave the way for the creation of an ecosystem.

For the consumer market, 5G SA compatible devices should be synonym with better coverage and improved latency as devices connected to a low frequency band in 5G but without connection to a 4G LTE (and thus EPC) could finally be covered directly in 5G. In NSA mode indeed, the control plane is handled by the 4G Core network. In the USA, where T-Mobile has launched SA on the 600 MHz frequency band, a 30% increase in coverage was observed and latency was reduced by 24% as compared to 5G NSA. Interestingly, as a result of 5G devices not supporting the aggregation between FDD and TDD in the sub 6 GHz, inferior throughputs on average were observed. Indeed, when connected in SA mode, devices were not capable of aggregating the FDD 600 MHz band with the TDD 2.5 GHz spectrum inherited from Sprint. With the arrival of devices capable of such carrier aggregation, the situation should change significantly (thanks to Qualcomm x60 modem or Mediatek M80).

In China, the three main MNOs have launched their SA network quite extensively. China Mobile for instance has deployed or upgraded 400 000 base stations to support SA mode and it plans to have 200 million of 5G SA devices on its network in 2021.

3. Infrastructure ecosystem

Infrastructure equipment is probably even more important than devices in the early building of an ecosystem, as they are used to test the technology features and concepts, even as the technology is being standardized within 3GPP. Equipment vendors were early in announcing their effort in building 5G technology, often by announcing trials efforts with Mobile Network Operators and/or chipset manufacturers. Those demonstrations were often focused on pieces of technologies or concepts, such as Massive MIMO, the use of mm-wave in different mobility scenarios…

Industry efforts have now resulted in early (and accelerated) standardization of the technologies and as more than 150 operators have commercially (as of mid-March 2021) launched a 5G network throughout the world, most equipment vendors have completed their 5G portfolio to meet the various needs of the market. Those solutions share more or less the same features, although each vendor has designed its solution around its main strength. These features are:

- 3GPP Release 15 compliance: Release 15 is the first official release of 5G. Before that, some equipment vendors have worked around unfinalized versions of the standard, or as is the case of network operators having built a pre-standard (such as Verizon with the 5GTF). As the Release 15 of 3GPP has seen its specs frozen, infrastructure equipment now highlights their full Rel. 15 compliancy.

- End-to-end offering: in the race to being the most advanced vendor, it is important to show full end-to-end product portfolio, which means having a core network solution, a transport solution, a base-station adapted to different scenarios (e.g. such as indoor or outdoor), and a “front-end” solution with diverse antenna

- A (virtual) core network solution: this is built to be deployed in the cloud for maximum flexibility and to support the deployment of certain network functions at different places in the network, in a centralized or more or less distributed (up to the edge of the network)

- Support for massive MIMO: Massive MIMO, beam forming and beam tracking and beam steering are key features to attain increased spectrum efficiency in 5G. The support of this feature is thus key for equipment vendors to assert 5G

- Support for sub 6 GHz and mm-wave: While mm-wave has received much of the attention in the race to 5G because of all the challenges associated in operating a radio network in these frequency bands (the 26 and 28 GHz bands notably), but C band below 6 GHz has also seen traction because of its roaming capabilities for 5G. In Europe, nearly all 5G deployments that have already taken place have been in this band rather than in the 26 GHz band, because of its better coverage capabilities and the feeling of operators that they are not yet running out of capacity (as compared to the U.S. for instance).

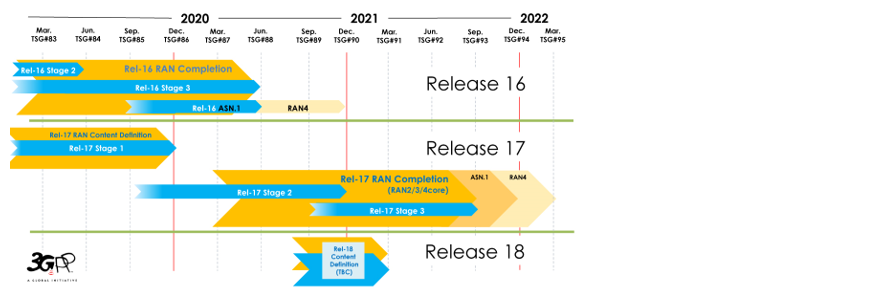

As Release 15 is now fully supported by equipment vendors and as first 5G Standalone Network with a native 5G core has been launched by the end of 2020, Release 16 is now finalized. Initially supposed to be frozen in March 2020, Release 16 has seen its frozen date postponed to June 2020 due to COVID-19 epidemic and compatible equipment has been launched on the market. Work on Release 17 has now already begun and should see its feature frozen in September 2021.

As for Release 16 is considered as the phase 2 of 5G and is aimed at complementing the previous release after the initial calendar was quicken to enable early 5G deployments. Release 16 brings the following capabilities:

- NR-U: it will now be possible to deploy 5G NR in unlicensed spectrum, not only with an anchor in licensed spectrum but also as This is notably aimed at serving the development of 5G private networks. NR-U will also make it possible to have an anchor in unlicensed spectrum.

- URLLC: while Release 15 focused on eMBB use case, but nonetheless bringing improved latency, Release 16 will support Ultra-Reliable Low Latency communication for critical applications, the main difference lying in the support for the Reliability in Rel 16. It is notably aimed at serving the needs of the Industrial IoT.

- Improvement to C-V2X communication with the support of communication directly between the vehicles under and out of coverage thanks to PC5

- Integrated Access Backhaul: to support the densification of the network when fiber is not easily available, it will be possible to use a NR wireless link from central locations to distributed cell sites and between cell

- Other enhancements to existing features: Massive MIMO, Dynamic Spectrum Sharing but importantly as well for devices energy-saving features (Wake Up Signal, adaptive MIMO Layer reduction, low power carrier aggregation control …)

The figure below present the update roadmap for 5G standard development:

5G standard development roadmap

Source: 3GPP

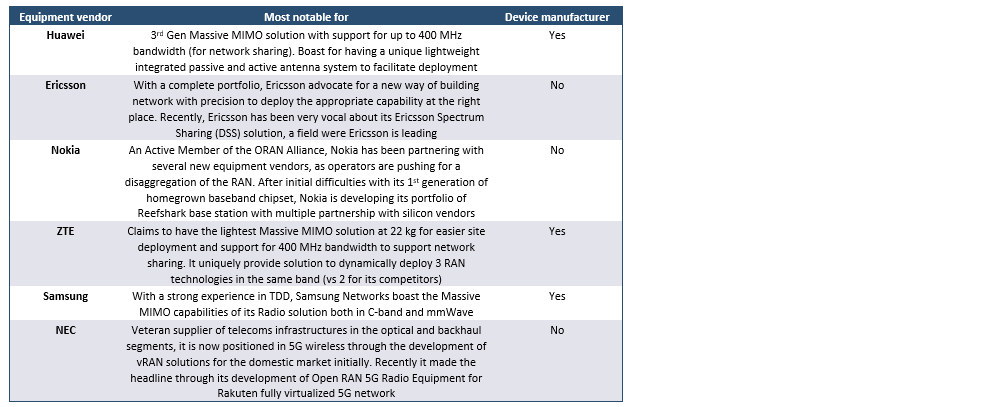

Presentation of the 5G portfolio of the main equipment manufacturers

Below, we present the 5G portfolio of each equipment manufacturer. Their claim is mostly similar and as for device baseband, those claims can be seen through different angles. Table below summarizes what stands out from each vendor solution:

Infrastructure equipment 5G solutions from major vendors

Source: IDATE DigiWorld, June 2020

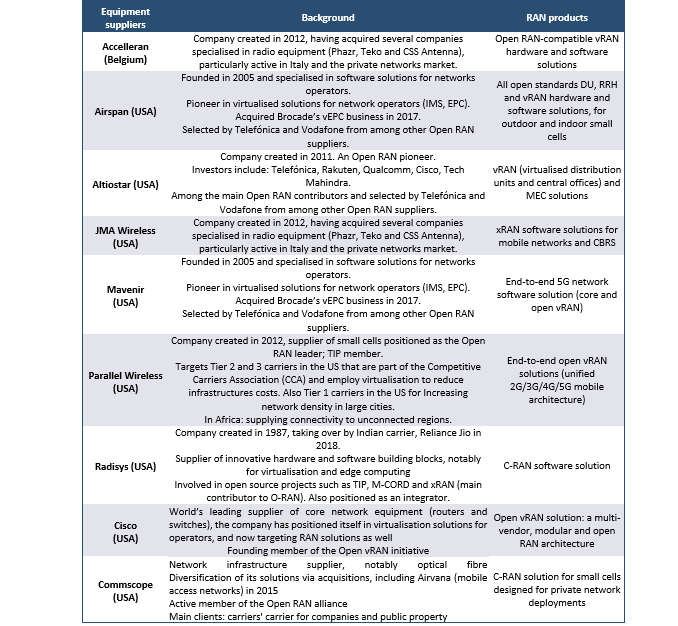

Open RAN and the expected rise of new network vendors

As the native 5G core network will be fully virtualized, the virtualization of the Radio Access Network (RAN) and the development of new RAN architecture are paving the way for the implementation of open and interoperable solutions on the network.

Initially pushed by MNOs to end their dependency on one or two single equipment provider it has been seen as an opportunity for new players to enter the RAN market with software solution while traditional equipment vendors excepting Huawei have been forced to more or less timidly supporting the movement to continue working with some Tier 1 mobile operators.

Mapping of new equipment vendor

Source: IDATE DigiWorld

In support of the development of a standardized interface between the different equipment that make up the RAN, alliances have been formed such as the TIP (notably) or the ORAN Alliance. More recently and in a more political approach, the Open RAN Policy Coalition has been formed in the US. Indeed, in the country, with no more mobile infrastructure equipment vendor on the market, the move is seen as way to rebuild a presence for infrastructures also considered as strategic for the independence of the country.

While still relatively limited in its breadth this move should be seen as a solid trend for the years to come. While “legacy” equipment vendors have initially developed a virtualized RAN solution, those solutions remained proprietary and did not provide the openness that operators had been calling for.

Recently, certain move by both greenfield operators and legacy operators have shown that the ecosystem was moving in the right direction. If the launch of Rakuten fully virtualized 4G network in Japan is being observed carefully, massive testing by major telcos such as DoCoMo in Japan, Etisalat in UAE and Telefónica are also an indication that Open RAN is there to stay.

At this point of development, Open RAN solution still lack maturity as compared to more integrated and proprietary solution as it require new (IT) competencies that few operators have yet. One issue with Open RAN today lies in the fact that, as operators are deploying a new Radio Access Technology, they also need to have an end to end control of what is happening in the network (especially as network slicing is seen as a way for operators to transform their business model). The more vendors solutions are deployed in the network, the more difficult it is to identify where error come from when they arise.

In the years to come thus, new equipment vendors are going to continue to progress on the market but biggest “legacy” vendors are not yet threaten, even though they need to rethink their positioning.

Presentation of main new equipment vendors

Source: IDATE DigiWorld

5G expanding into lower frequency band for increased coverage (and capacity)

In 2020 and beyond, after early deployments, 5G has expanded its coverage thanks to lower frequency bands. This would not have been possible without flexible solution such as Dynamic Spectrum Sharing (DSS) which enable to seamlessly and dynamically “re-farm” 4G spectrum for 5G application. Instead of dedicating a fixed portion of a frequency band to 4G or 5G, the idea is to support both 4G and 5G users in the same frequency band. It is especially useful for sub 3.5 GHz bands used by 4G (the mid and low frequency bands of 5G) as it will expand 5G coverage outside the spotty area where “higher band 5G” has been deployed. This feature is part of 3GPP Release 15 and while its support has been announced first by Qualcomm with its x55 5G chipset at MWC 2019, it is supported by all the 5G baseband players as well as most equipment vendors which have announced support for this feature. Ericsson is today considered as a leader but Samsung, Nokia, ZTE have all released their solution. Quite uniquely, and ZTE supports the deployment of a third radio access technology such as 2G or 3G together with 4G and 5G.

It should not be seen as a way to deploy 5G in a single band but as a way to increase throughput in low frequency bands where little bandwidth is available. DSS is thus meant at being used in carrier aggregation configuration. In the very low frequency bands such as in the 600 MHz or even in the 700- 800 MHz band, the spectrum available is often quite limited and as such offers very limited performance. This, however, can be somehow mitigated by increasing the receive and transmit diversity with for instance 4×4 MIMO instead of 2×2 MIMO and the use of high gain antennas for instance in devices such as CPE to be used in FWA in rural areas. At the beginning of March 2021, Ericsson and Unisoc demonstrated more than 600 Mbps throughput using the n28 (700 MHz) frequency band.

It is to be noted that while the solution seems interesting on the paper, as every new technology, it also needs some maturation. Indeed, it has been reported that some DSS solutions could incur a reduced spectrum efficiency on the 4G part of the spectrum. As a result of this initial situation, some operators have decided to allocate fixed portion of their spectrum to 4G and 5G instead of dynamically managing the allocation of resources depending on the network load.

Quite importantly as well, the support for low frequency bands in 5G will be critical for the launch of Standalone 5G, where the native 5G Core network will be able to handle the control and signaling plane, thus paving the way for more advanced/transformational 5G capabilities such as network slicing.

Outlook for 5G features deployments worldwide

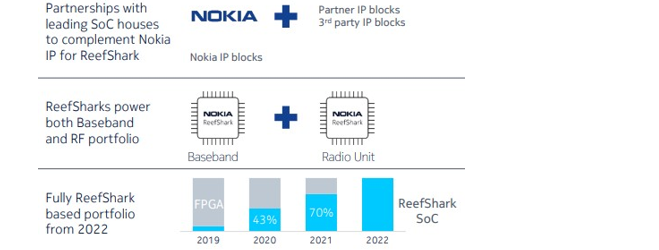

The critical importance of semiconductor in building a differentiated (more efficient) portfolio

With the ever-complexification of radio technologies, and in a very competitive environment, the chipset within the infrastructure is increasingly becoming a matter of differentiation. But as most of the main equipment manufacturers are today claiming to somehow design their own chipset, making bad choices can decisively impact competitiveness as recently experienced by Nokia.

Nokia indeed introduced its 1st generation of ReefShark chipset in January 2018 touting its capability to enable the reduction of massive MIMO antennas by a factor of two while reducing the power consumption of baseband unit by 64%, a key benefit as both size, weight and power consumption has a direct impact on operator OpEx. However, in order to achieve this prowess, Nokia made a chip design choice that put the Finnish vendor in a difficult position. Indeed, by making the decision to use FPGA, a programmable chipset, rather than a dedicated ASIC, Nokia actually quite negatively impacted its product margin. FPGAs indeed, provide flexibility by enabling to reconfigure the chip after it has been designed, something that Nokia believed to be an advantage. But that turned out to be a serious disadvantage as FPGAs are more expensive than ASICS and the time to market that this design choice was supposed to bring disappeared as one of its suppliers experienced difficulties in the manufacturing of the chipset with its 10 nm foundry process. Nokia finally departed from this design choice by finally designing a more competitive SoC through partnership with silicon specialists such as Broadcom, Intel and Marvell for its range of products. This turn of events however quite negatively impacted Nokia’s competitiveness. As of March 2020, Nokia indicated that 17% of its 5G products were powered by Reefshark with the objective of reaching 35% by the end of 2020, 70% by the end of 2021 and 100% by the end of 2022. At the end of Q4 2020, Nokia reported that 43% of its 5G shipments were powered by ReefShark. ReefShark is used for both the baseband and the Radio Unit.

The critical importance of ReefShark for Nokia

Source: Nokia

Meanwhile, Huawei launched its 1st generation of own 5G base station processor called Tiangang in 2019. According to the company, this chip brings several improvements in Active Antenna Units with 50% smaller, 23% lighter and 21% less power-consuming base station. However, because of the strengthened ban on making business with Huawei, the company is facing difficulties in producing its own chip, after TSMC was forced to stop producing Huawei chipset and the future of Huawei capability to design and produce new chips seem uncertain.

As a semiconductor company, Samsung has also invested in the development of its own base station chipset whose 2nd gen was launched in 2019. In April 2020, it announced the selection of Xilinx FPGA to improve the beamforming capabilities of its equipment and more recently in March 2021, it announced a new Massive MIMO 5G SoC developed in collaboration with Marvell and that promises better coverage and importantly as well a 70% power efficiency improvement over the previous generation.

With all the surge of 5G networks and the need to support ever increasing capacity, Massive MIMO has a critical role to play especially in the mid-band where it is particularly adapted and as well required to make up for the reduced coverage of higher bands. This new approach however, is causing an explosion of energy consumption in absolute value and explains why so much focus is being drawn on improving Massive MIMO antenna solutions energy consumption. Not surprisingly then, Ericsson announced in February 2021 that its new mid-band 5G radios and suite of six RAN compute products would be powered by its next generation custom silicon called Ericsson Silicon. This new chip must increase performance of its Massive MIMO antennas while reducing energy consumption and physical footprint (size and weight). One of the radio is presented by Ericsson has being the lightest Massive MIMO Active Antenna Unit on the market with a 20 kg weight. Previous record was held by ZTE with its 22 kg AAU solution.

Last but not least, Qualcomm, already designing chipsets for small cells, announced last November that it would also enter the 5G base station chipset market focusing on open vRAN solutions with base station to antenna chipset solutions. Leveraging on its expertise in 5G the company aims at competing with players such as Intel, Marvell, Broadcom but also Nokia and Ericsson.

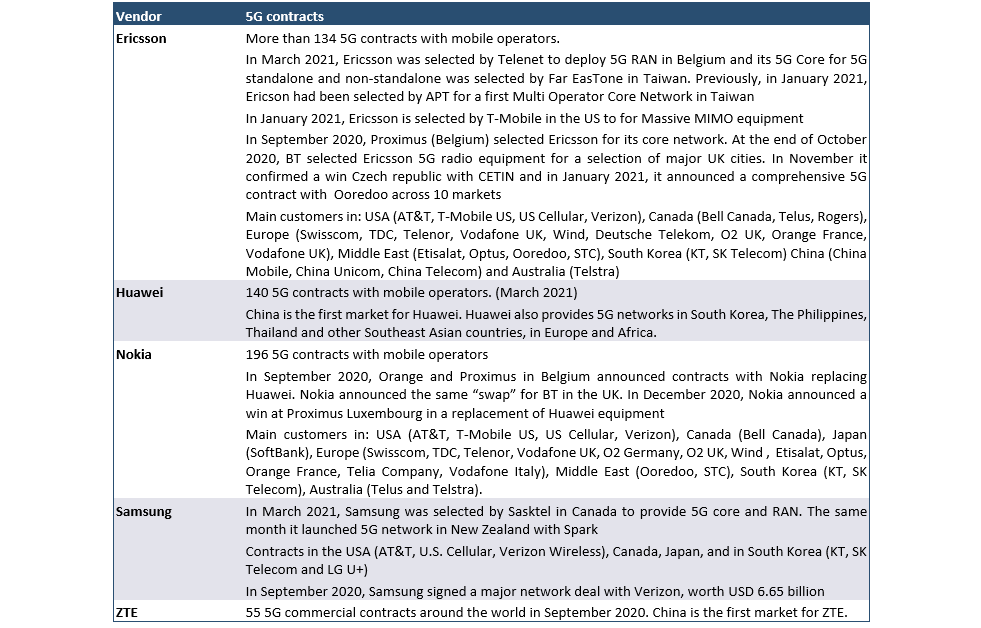

5G infrastructure contracts announcements

In the race to 5G contracts for equipment manufacturers, it is sometimes difficult to say who is really winning so far because of not all the figures being released and made public, not at the same time and sometimes as well with no precision on the scale of the contracts. To make it worse, the situation seems to change quite rapidly as exemplified by Nokia figures. As of March 2021, Nokia had secured 196 5G commercial engagements and 55 live 5G networks contract Roughly one year ago, we stated that Nokia was considered to be trailing behind in terms of contracts, Nokia, however, stating that they were leading in terms of the comprehensiveness of the 5G solution sold to operators: “More than half of the deals that we have signed actually include more than just radio”. It is to be noted here that those deals likely include enterprise customers, 5G Private networks being known as having been a particular focus for Nokia.

As of end of February 2021, Ericsson states that it currently has 134 5G commercial agreements or contracts with unique operators out of which 76 have been publicly announced and out of which 83 are live 5G networks. As for Huawei, it claimed 140 commercial 5G networks deployed in 59 countries. In Europe, Huawei claims to have more than 46 commercial 5G contracts signed and to have shipped 120,000 5G base stations.

While the American ban on Huawei has been seen as an opportunity for its competitors it has not prevented the Chinese infrastructure vendor to claim the leadership in the past but this is something that is difficult to follow over time. Looking at overall market share of telecom equipment revenues, it is still considered globally that Huawei is leading, with, according to Dell’Oro a 31% market share during 2020, as compared to 15% for Nokia and 15% for Ericsson. Despite difficulties in Europe, the market dynamic in China is helping Huawei to strengthen its position. Together with ZTE, it is estimated that Chinese equipment manufacturers hold 40% of the market in revenues.

Network contracts announcement by infrastructure vendors – Based on figures known as of December 2020

Source: IDATE DigiWorld

Source: IDATE DigiWorld